The enhanced Child Tax Credit (CTC) was reinstated in the president’s budget this month.

Rocky Harper, 44, has had a difficult financial year in the last year. Inflation, in particular, has eaten away at his paychecks, which support his family of four.

“I had to switch careers last year to become a truck driver, because my old job could not pay my bills anymore. “Now I have to spend all of this time away from my family just to pay the bills,” the Arizona resident explained to Yahoo Finance while driving through South Dakota. “My wife is basically a single parent with two kids at home, and I’m out here just making money and living in the truck.”

Another factor that has exacerbated Harper’s financial difficulties in the last year: no more monthly Child Tax Credit (CTC) payments.

“The credit helped me start catching up again, but then it vanished and inflation rose,” he explained.

The enhanced credit, which increased the tax benefit and distributed half of it in advance in monthly installments in 2021, expired at the beginning of 2022, leaving little political clout to make the pandemic-era changes permanent. That could change now that President Biden has included the CTC in his annual budget, which was released earlier this month.

While the budget itself has little chance of becoming law with the GOP controlling the House, the inclusion of the CTC may rekindle debates about its merits, especially as inflation continues to erode more budgets, credit card delinquencies begin to rise, and government food aid shrinks.

“Those expansions were really exciting to see being revived in the president’s budget. “Monthly payments and giving families more money, as well as making those credits refundable so that our lowest-income families can access them,” Joanna Ain, associate director of policy at Prosperity Now, told Yahoo Finance. “That would be enormous.”

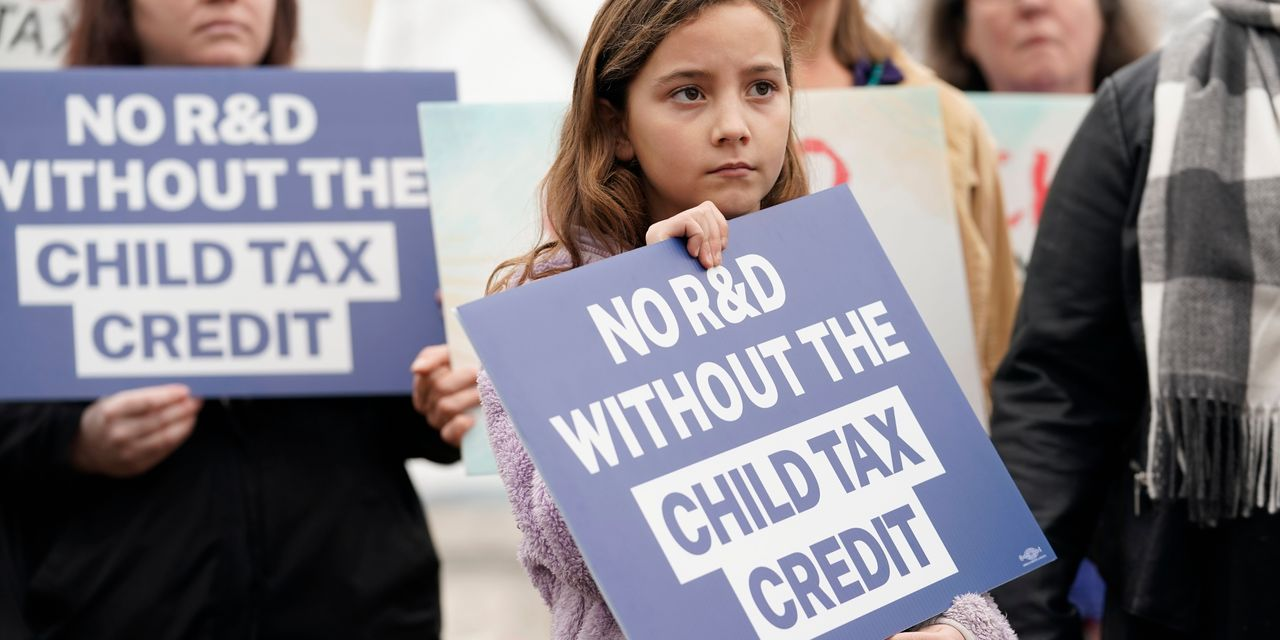

The enhanced Child Tax Credit was reinstated in the president’s budget this month.(Photo: Mandel Ngan / AFP – Getty Images)

How the Child Tax Credit was Expanded Worked

The temporary expansion of the Child Tax Credit enacted as part of the American Rescue Plan in March 2021 broadened the benefit in several key ways, assisting many economically vulnerable people.

To begin, the maximum credit amount was increased from $2,000 to $3,000 for each child aged 6 to 17, and $3,600 for children under the age of 6. For the first time, the age limit was raised to 17. Previously, the maximum age was 16.

Lawmakers also made the CTC fully refundable, which means that even if you didn’t owe taxes, you could still claim the entire credit. Only $1,400 of the $2,000 credit was previously refundable. The American Rescue Act eliminated the previous $2,500 minimum income requirement, allowing those without jobs to qualify for the first time.

“We also delivered half of the credit prior to filing your tax return,” Elaine Maag, a senior fellow at the Urban-Brookings Tax Policy Center, previously told Yahoo Finance. “Almost all families with children started getting payments in July, and they received a monthly payment from July to December [2021].”

In 2021, the Internal Revenue Service will pay half of the credit in monthly installments to approximately 35 million taxpayers with 60 million children. Families who chose not to receive the advance payments could still claim the full credit on their 2021 tax return.

“The monthly CTC was extraordinarily flexible and helped parents and children in ways that other government programs couldn’t dream of,” Humanity Forward’s director of public affairs, Greg Nasif, told Yahoo Finance. “Child care cannot be subsidized in rural Montana towns that lack daycare centers. However, by converting the CTC to monthly payments, you can redirect resources toward family budgets and allow parents to determine what their families require.”

The CTC provided “the opportunity to invest in children.”

The expanded Child Tax Credit had an almost immediate positive impact.

The Center on Poverty and Social Policy at Columbia University discovered that by December 2021, the monthly tax credits were keeping 3.7 million children out of poverty, up from 3 million when the credits were first implemented. The payments also reduced child poverty by 30% on a monthly basis.

Several studies also found that the monthly payments aided in the protection of family finances during the pandemic. According to the Census Bureau, in the fall of 2021, American households consistently reported using the CTC to cover basic needs such as food, rent or mortgage, and utilities.

That was the case for Zebulon Newton, a North Carolina resident, who received his final CTC payment of $550 in December 2021 for his daughters, ages 4 and 7.

“Childhood life improved for six months,” the 40-year-old father told Yahoo Finance last year, adding that he used the money for child care and to put healthier food on the table.

“Perhaps the credit amounts weren’t necessarily life-changing for some, but they gave the lowest-income families who have historically been shut out of these programs the opportunity to invest in children,” Christopher Wimer, co-director of Columbia University’s Center on Poverty and Social Policy, told Yahoo Finance. “Many people were able to get through the day a little easier for the first time.”

Read also: Social Security: Retirement Age For Americans In Their 20s Will Be Raised