Businesses are celebrating the passage of the “millionaires tax,” which will increase investment in education and transportation, two of the most significant bottlenecks for employers and our economy.

If lawmakers consider further tax changes, they should remember the main reason for last year’s stalled tax proposals: to help families cope with the costs of inflation. Simply put, direct benefits to the families who require them the most.

The most effective way to provide tax relief is to increase refundable tax credits, which are particularly beneficial to low- and middle-income households because they receive refunds when the credit exceeds the amount owed. The Massachusetts Senior Circuit Breaker Tax Credit assists seniors who are unable to afford high housing costs. The Earned Income Tax Credit helps working families with low or moderate incomes and should be expanded to include seniors, adults under the age of 25, and immigrants who file taxes without a Social Security number. There is no reason to exclude these groups, who frequently require it the most.

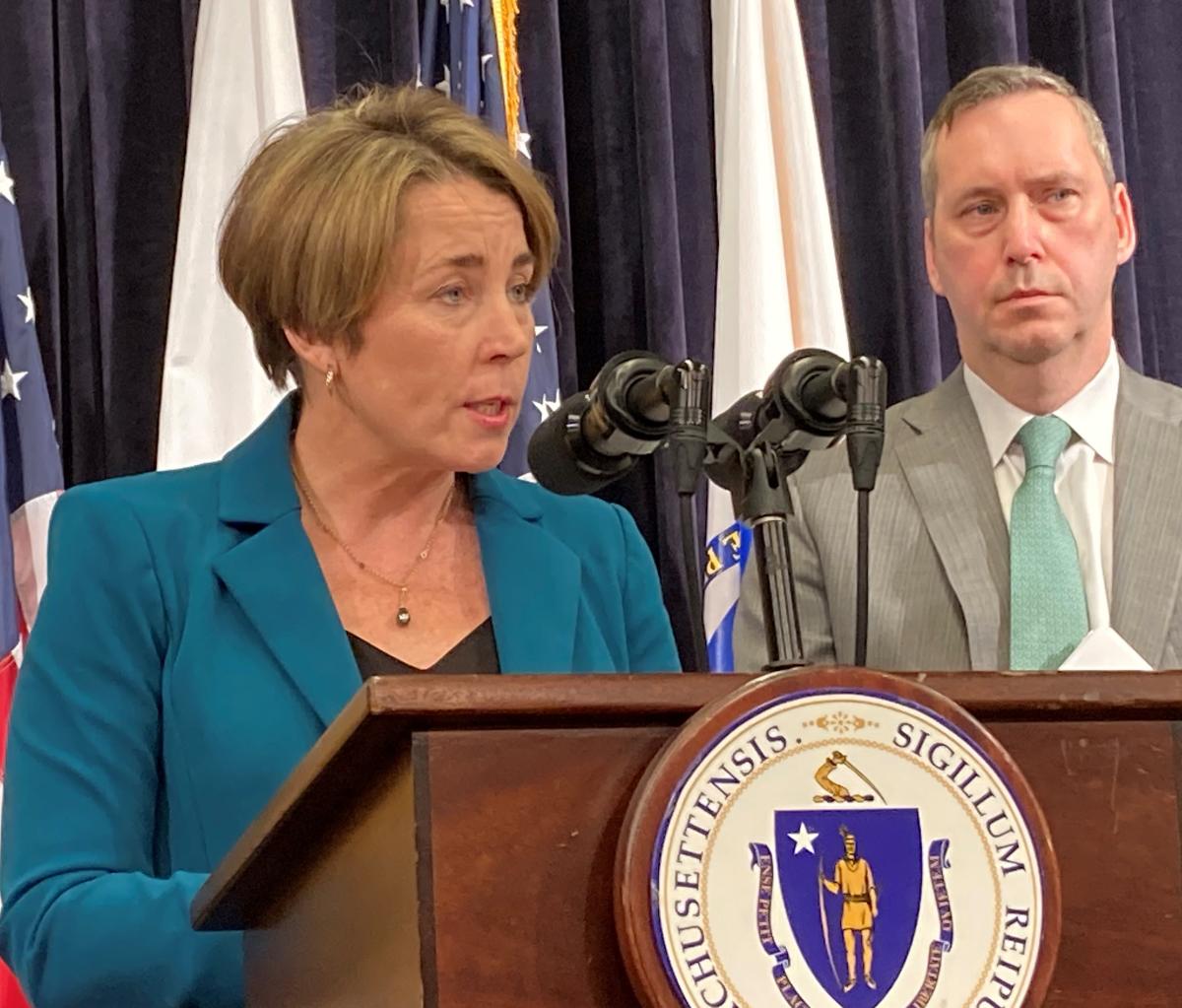

Governor Maura Healey recently proposed increasing the credit for those caring for loved ones to $600 per dependent in her recent campaign.(Photo: Yahoo News)

Governor Maura Healey recently proposed increasing the credit for those caring for loved ones to $600 per dependent, whether a child, an adult with disabilities, or a senior. A family with two young children and a live-in grandparent, for example, would receive $1,800 per year. This would significantly improve the quality of life for families struggling with the high cost of living in Massachusetts.

Even with our new tax, the top 1% of households will still pay a lower share of their income in taxes than low- or middle-income families. The estate tax is the only revenue source aimed at ensuring that economic success does not depend on being born into a wealthy family.

Cutting estate taxes would widen the economic and racial wealth disparities. If such cuts occur, they should only apply to the smallest currently taxable estates.

True “relief” should not benefit wealthy families or profitable corporations. It delivers the most by giving to those who will benefit the most from each dollar.

Massive inflation has harmed every Massachusetts resident, resulting in higher food, gasoline, and housing prices, as well as skyrocketing energy bills.(Photo: https://www.wawanesa.com/)

Massive inflation has harmed every Massachusetts resident, resulting in higher food prices, higher gasoline prices, higher housing prices, and skyrocketing energy bills.

Business owners are not immune to these financial strains, and now face additional burdens as a result of the passage of Ballot Question 1, the so-called “millionaires tax,” which will tax individual income above $1 million at a rate of 9 percent.

Tax competitiveness is more important than ever. If disgruntled employers leave the state, so do their jobs, philanthropy, and goods and services.

Legislators must act quickly to enact comprehensive tax relief that mitigates the effects of the ballot referendum and keeps employers — as well as employees and their families — in a thriving Bay State.

The North Shore Chamber of Commerce supports tax breaks for low-income individuals and seniors. Furthermore, the Chamber specifically requests tax changes that it believes will significantly improve the state’s business competitiveness, such as the following:

• Increase the Commonwealth’s existing estate tax exemption from $1 million to $2 million and eliminate the cliff effect, ensuring that only the amount above $2 million is taxed — not the first dollar. When an estate is worth more than $1 million, the tax is applied to the entire estate. Only 12 states continue to levy estate taxes. To remain competitive, Massachusetts must reform this antiquated tax.

Reduce the short-term capital gains tax from the current rate of 12 percent to 5%. This would tax the money in the same way as other income, bringing Massachusetts in line with the majority of other states.

• Governor Maura Healey has proposed increasing the child-care credit to $600 per child. Child care is a critical workforce issue, and more needs to be done to assist working parents.

• Raise the state’s rental deduction cap from $3,000 to $5,000, based on 50% of rent paid. Our workforce requires affordable housing, and this tax policy change will assist lower-income employees in remaining in Massachusetts.

Massachusetts taxpayers are entitled to relief. With the state’s finances in better shape than expected, the time has come for substantive tax reform.

We urge Governor Healey and the state Legislature to use the Commonwealth’s current strong revenues and federal relief funds to lead the Commonwealth to greater business competitiveness and opportunity for all.

Read also: Tax Rebates: Check To See If You Qualify To Get Up To $800