Robots that could eliminate countless jobs may be the next big political challenge in the US and politicians are already discussing how to deal with a potentially inevitable unemployment surge driven by robots and artificial intelligence.

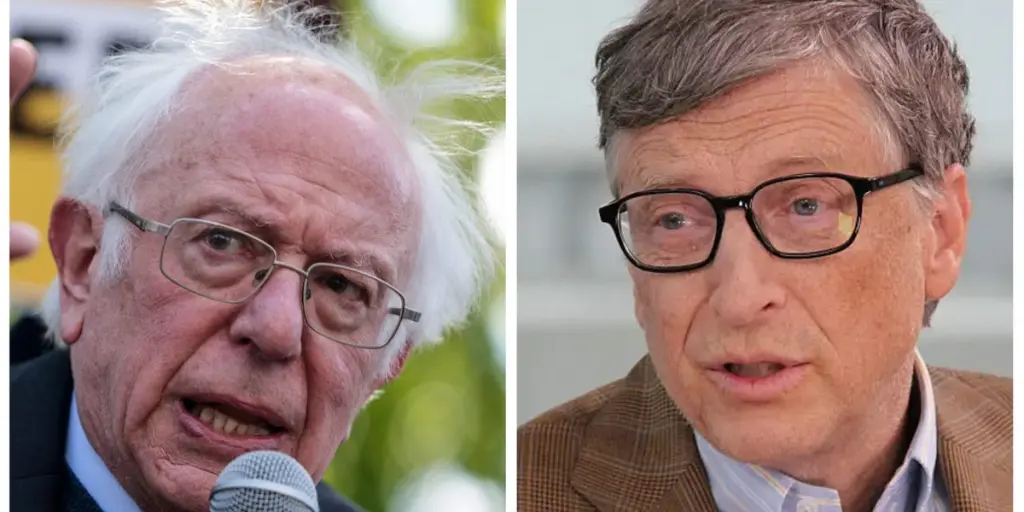

Bernie Sanders Supports Bill Gates To Tax Robots That Could Eliminate Countless Jobs (PHOTO: Fortune)

Bernie Sanders Supports Bill Gates To Tax Robots

The US government is still unprepared for if automation and A.I. really could wipe out almost half of the jobs. Recent AI products like ChatGPT could predict a future where even white-collar workers are urges aside by artificial intelligence. And a 2020 study found that adding a single robot to expedite manufacturing jobs can eliminate 3.3 jobs around the country.

Sen. Bernie Sanders released a new book Tuesday, It’s OK to Be Angry About Capitalism, and how automation and technology will affect labor markets is top of mind for politicians like Vermont. Moreover, Sanders claims that current tax paradigms are not equipped to handle disruptive technologies like automation and artificial intelligence. Higher taxes targeted at companies that choose to use robots rather than humans could soften the blow, an argument that billionaire and tech philanthropist Bill Gates has been making for a long time.

Gates notably called for a robot tax during an interview with Quartz in 2021, which he said companies taxed for employing robotics could still come out ahead, considering how much money and time automation could keep businesses in the long run. Like Sanders, Gates said governments and companies need to start keeping these conversations now before the pace of technological advancement threatens to overtake both.

Government And Business Tackling Technology’s Impact On Jobs

Sanders has tried to address how automation and A.I. could affect the labor market several times and won’t be the last. Automation’s threat to jobs was a frequent talking point during the Democratic primaries ahead of the 2020 presidential election, with entrepreneur Andrew Yang notably proposing a universal basic income to shield workers from the disruptive effects of automation. Sanders opposed Yang with his statements at that moment, stating that people still “want to work” despite the difficulties posed by new technologies.

However, Sanders called advancements in automation and artificial intelligence a “transformational moment” and added that he wants “working people to be involved” in the new economy. Sanders said that while he is not “anti-technology,” he wants to witness policy enshrined that ensures workers are set to benefit from technological leaps including automation and AI.

During the interview, Sanders said Gates’ proposal of a robot tax idea was one way to do it when it comes to mitigating technology’s damaging impact on jobs but repeated that policy responses should go beyond stop-gap solutions and put the well-being of employees front and center. “It’s not just taxing the robots. It’s this whole question of an economic modification. Are working-class people going to benefit from that or just the billionaire class?” he said.

READ ALSO:

$500 Monthly For Chicago Residents As Part Of The Guaranteed Income Program