Most of the federal payments have already run out, but there are still some states in the process of distributing aid.

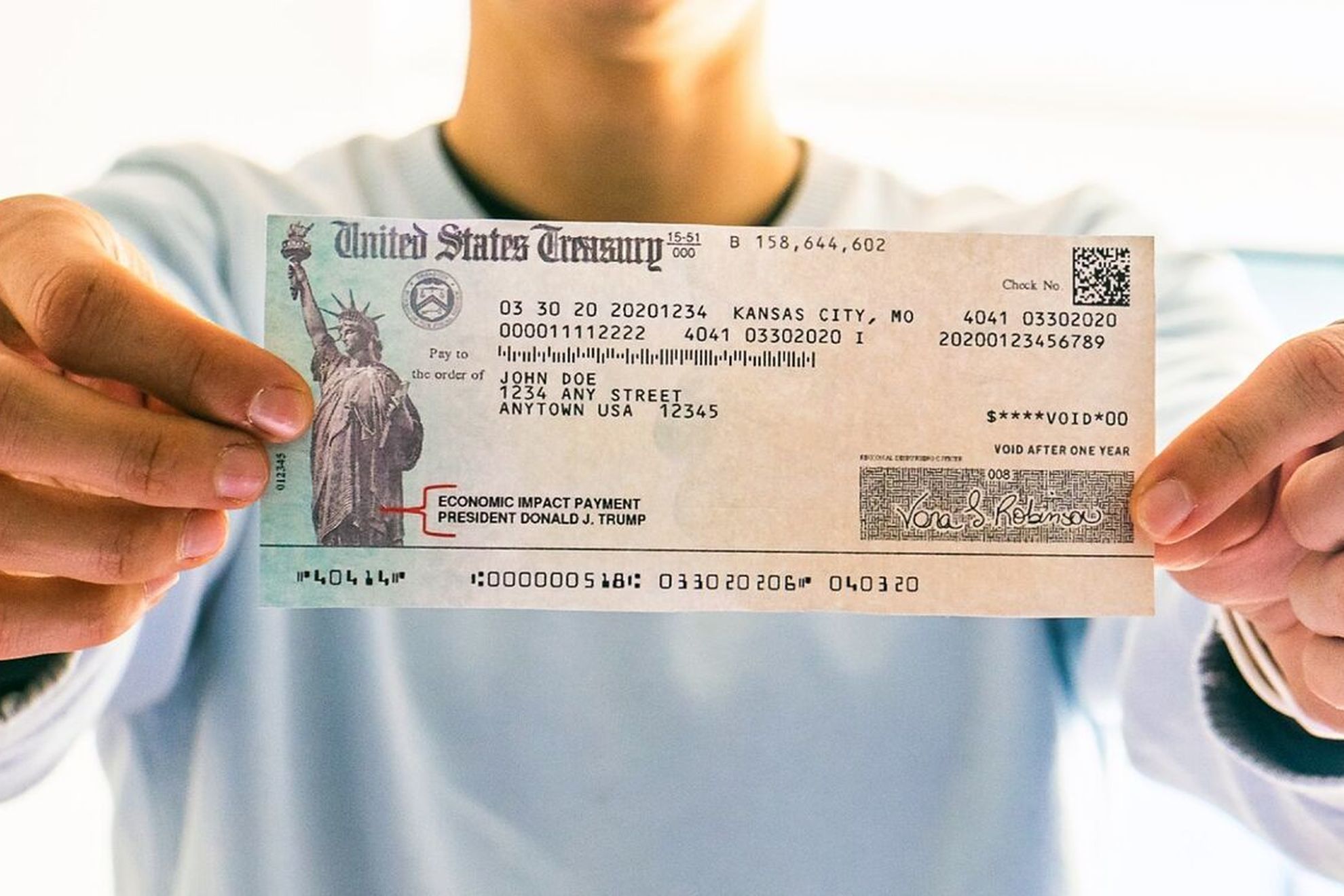

Many programs ended in 2022, but some states still have payments scheduled for 2023. (Photo: Marca)

2023 Stimulus Payments: Things You Need to Know

The American economy went into full shutdown mode in response to the coronavirus pandemic in March 2020. The U.S. government nearly immediately implemented a series of stimulus packages in an effort to support businesses and consumers.

As posted by Yahoo Finance, even though most of the federal payments have already run out, there are still some states in the process of distributing aid. 2022 marked the end of many programs but a few states still have 2023 payments on their schedule.

California

California residents are to receive inflation relief checks of up to $1,050, either as a direct deposit or a debit card. 95% of the payments are expected by the state to go out this year and about 5% of checks won’t go out until Jan. 15, 2023.

The amount of rebates start at $350 and is based on a combination of income, household size, and tax-filing status. Singles earning $250,000 or more and couples earning at least $500,000 are ineligible.

Colorado

Residents of the state who have filed their 2021 return by June 30 should have gotten a physical check for $750 by Sept. 30, thanks to the 1992 Taxpayer’s Bill of Rights (TABOR) Amendment. (Joint filers will get $1,500.)

As per a signed bill by Gov. Jared Polis last May, people are to get the refunds to taxpayers sooner. This will be more than half already cashed by late August. Those filers given an extension and filed by the Oct. 17 deadline will receive their refund by Jan. 31, 2023.

Many programs ended in 2022, but some states still have payments scheduled for 2023. (Photo: Marca)

Idaho

In February 2022, Gov. Brad Little signed a bill giving $75 to each taxpayer and dependent, or 12% of their 2020 state income tax return, whichever is greater. In March, checks start going out and residents can review the status of their rebate online.

The amount of the rebate is greater of 10% of a taxpayer’s 2020 income tax liability, $300 for single filers or $600 for joint filers. The state Tax Commission anticipates sending about 800,000 payments totaling as much as $500 million.

New Jersey

$2 billion worth of property tax rebates are to be sent out to 2 million New Jersey residents. The rebate amount is income-based, with homeowners earning up to $150,000 qualifying for $1,500 and those earning $150,000 to $250,000 receiving $1,000.

There will also be $450 for renters as long as they earn no more than $150,000. Payments are projected to arrive no later than May 2023.

Pennsylvania

The state of Pennsylvania began sending out payments to older renters, homeowners and people with disabilities in July 2022, but the deadline for filing a claim was Dec. 31, 2022. This only means that payments will be available in 2023 as well for qualifying residents who get their paperwork in before the deadline.

The maximum standard rebate is $650, but those who qualify for supplemental rebates, as calculated by the state, may receive as much as $975.

South Carolina

$800 payments are already being issued to South Carolina’s qualified residents in Nov. 2022. Those who filed their tax returns before the Oct. 17 deadline received their payments before the end of 2022, but those who filed after the Oct. 17 deadline — but before Feb. 15, 2023 — will receive their payments in March 2023.