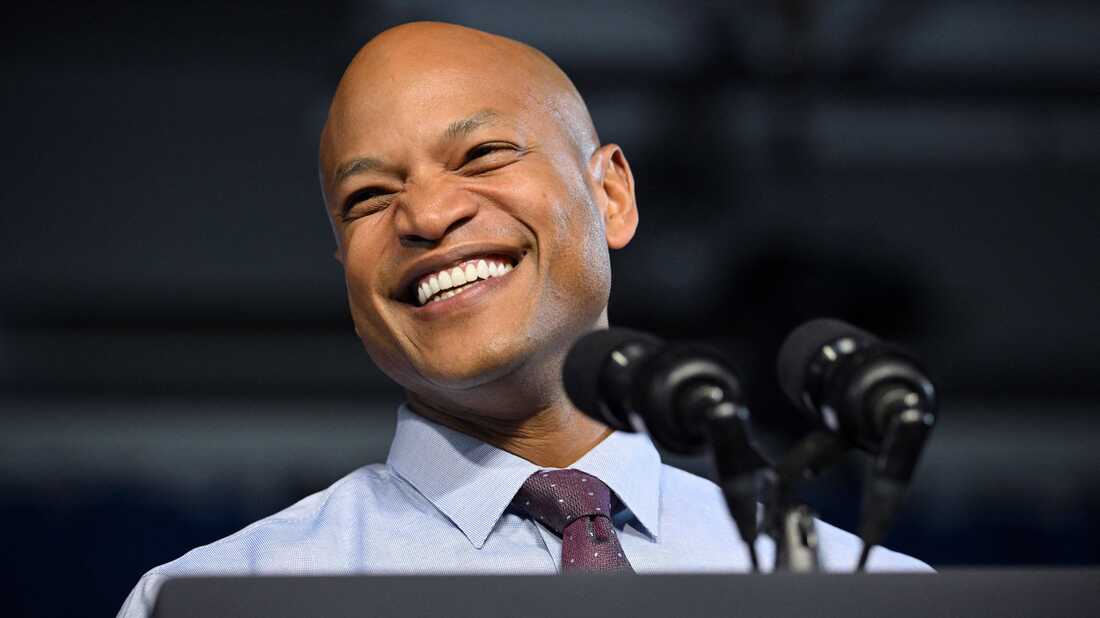

Maryland Gov. Wes Moore testifies before the General Assembly to support Tax Cut 2023 for veterans and three other proposed bills.

Tax cuts 2023 for veterans is a priority in Maryland. (Photo: NPR)

Tax Cut 2023 for Veterans

Gov. Wes Moore testifies before the General Assembly to give his support in four bills and that includes Tax Cuts 2023 for veterans. This is the very first time after nearly 36 years that a governor in Maryland testifies before the General Assembly to give support for different bills.

In a published article in The Baltimore Sun, The Keep Our Heroes Home Act up to $40,000 of military retirement income from state taxes if the Tax Cut 2023 for veterans will be considered. The present law in the state exempts veterans who are 55 years old and above up to $15,000 and up to $5,000 for those who are 55 years old and younger.

Gov. Moore said, “They’re building their lives here in the state of Maryland and we cannot continue to lose them to other states. As I’ve said before, I refuse to let this state be a farm team for other states,” He said this to support four bills and urge lawmakers to pass the bills.

READ ALSO: State Relief Checks: What Should You Do If You Already Filed Your Tax Before IRS Guidance?

Lawmakers Appreciate Proposed Tax Cut 2023

House Ways and Means Committee Chair Vanessa Atterbeary said that Gov. Wes Moore’s appearance to give support to four bills including Tax Cut 2023 only showed the governor’s willingness to work with the General Assembly.

The public events and public statements last month just indicated the eagerness of the state governor to prioritize his bills, especially for the veterans. He emphasized the Tax Cut 2023 as one of his priorities for his first legislative session, according to Maryland Matters.

Furthermore, an amount of $33 million will be dedicated for the Tax Cuts 2023 from his proposed $63 billion proposed budget. Gov. Moore told reporters after his testimony that he believes the bill would pay for itself in the long run.

READ ALSO: Biden Administration Releases Approved Student Loan Relief Applications