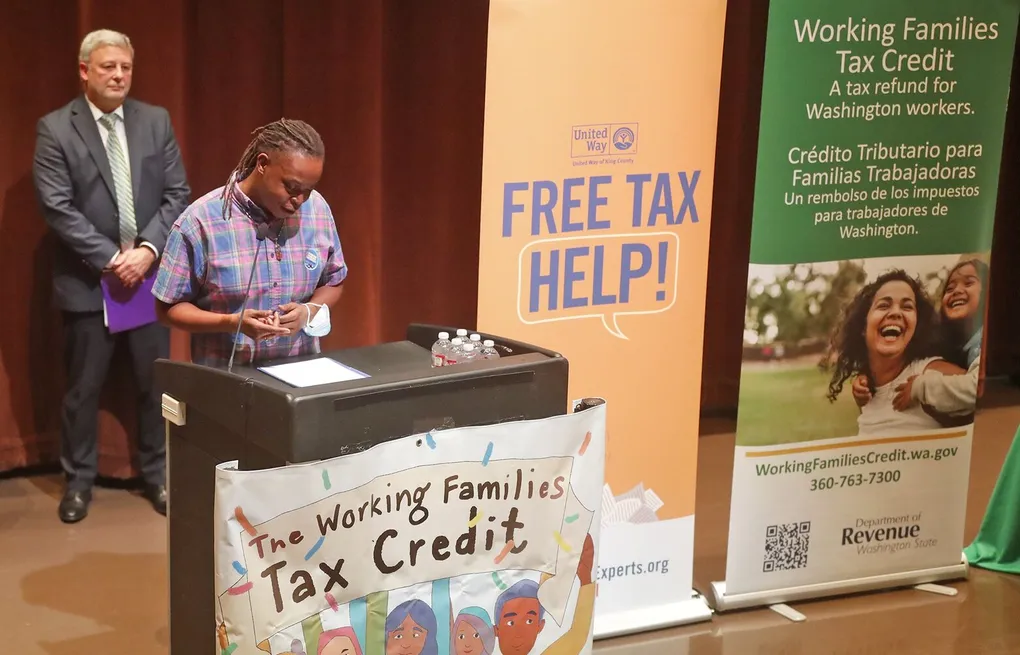

Washington State Department of Revenue launched the Working Families Tax Credit (WFTC). (Photo: The Seattle Times)

Residents of the Evergreen State now have a new annual tax credit available that could be worth up to $1,200. On February 1, the Washington State Department of Revenue launched the Working Families Tax Credit (WFTC), which refunds residents a portion of sales tax paid each year.

The WFTC is intended to help low-to-moderate-income households achieve financial stability. This year, up to 400,000 eligible Washington workers and their families could receive money back. The credit is modeled after the federal Earned Income Tax Credit (EITC) program, which is widely regarded as one of the most effective tools for reducing poverty across the country.

READ ALSO: IRS Advises Taxpayers Not to File Federal Tax Yet, Here’s Why!

Washington State Department of Revenue launched the Working Families Tax Credit (WFTC). (Photo: Earn Into Wealth)

Who can Claim the Working Families Tax Credit?

The Washington State Department of Revenue outlines the following requirements, which must all be met to be eligible for the WFTC:

- Have a valid Social Security Number (SSN) or Individual Tax Identification Number (ITIN)

- Identification Number for Taxpayers (ITIN).

- In 2022, you must have spent at least 183 days in Washington (over half the year).

- Be at least 25 years old and under 65 in 2022 OR have a qualifying child.

- I filed my federal tax return for 2022.

- Eligible to claim the federal Earned Income Tax Credit (EITC) on their tax return for 2022 (or would meet the requirements for EITC but are filing with an ITIN).

What are the eligibility standards for the Working Families Tax Credit?

Individual and family maximum credit amounts range from $300 to $1,200, depending on qualifying children, marital status, and income level. Like the federal EITC, the Working Families Tax Credit stipulated that the amount decreases as earnings exceed the income thresholds, with a minimum refund of $50 regardless of the number of qualifying children. The income eligibility thresholds listed below are based on the 2022 Federal Earned Income Tax Credit and may change in subsequent tax years.

READ ALSO: Will There Be More Child Tax Credit This 2023? Here’s What You Should Know