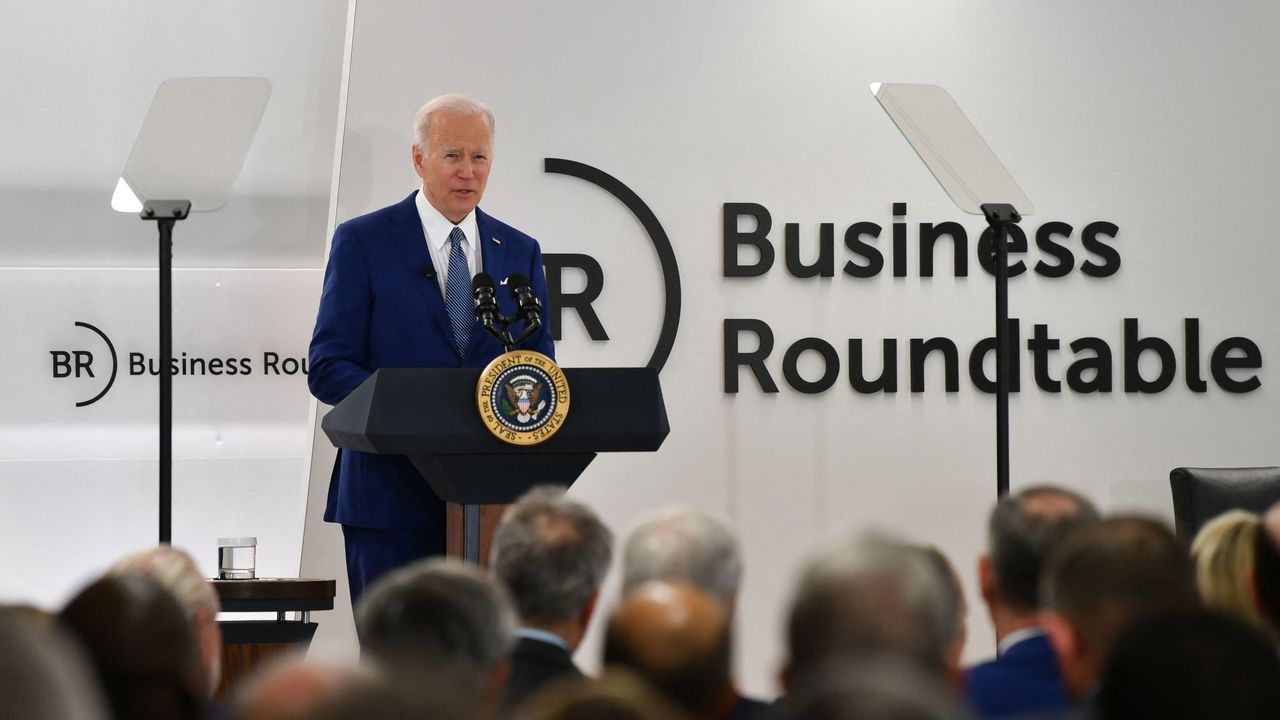

President Joe Biden’s budget proposal for the year 2024 includes policy changes to energy and education, increasing taxes on corporations and high earners, new programs, and higher revenue.

Biden’s Budget: Will The Tax Bill Increase? (PHOTO: Peterson Foundation)

Biden’s Budget: Tax Bill Increases

On March 9, 2023, President Joe Biden released his budget for the year 2024 and said he would raise taxes, but he restate that this is not applicable to Americans whose annual earnings are lower than $400,000. Biden’s budget proposed tax increases on businesses and individuals.

Those Us Citizens who are millionaires and billionaires will now stop paying 3%. Declaring that those wealthy people will now should a much heavier tax than before. The higher tax would pay by several programs and rich individuals will help lower the national debt. It will decrease the nation’s shortfall to $3 trillion in the next 10 years.

Biden’s Budget Proposal is heavily criticized by the Republicans but President Biden asked the Republicans to also present their budget proposal and plans on how to reduce the state’s deficit in the upcoming years. Their proposal includes restricting federal spending in 2024. They said this proposal would save $3.0 trillion to $ 3.8 trillion in the long run.

READ ALSO: Tax Debt Liability: How Does Fresh Start Program Help

Biden’s Budget: Changes Tax Bill In The Coming Years

White House respond on March 20 to the Republican’s proposal and released a statement that it would be so hard for the families and that there are so many keys that will be affected. President Biden’s administration will release more information about President Biden’s Budget proposal for the Us Citizens to know about it.

READ ALSO: Income Tax Claims: IRS Extends The Time For Filing