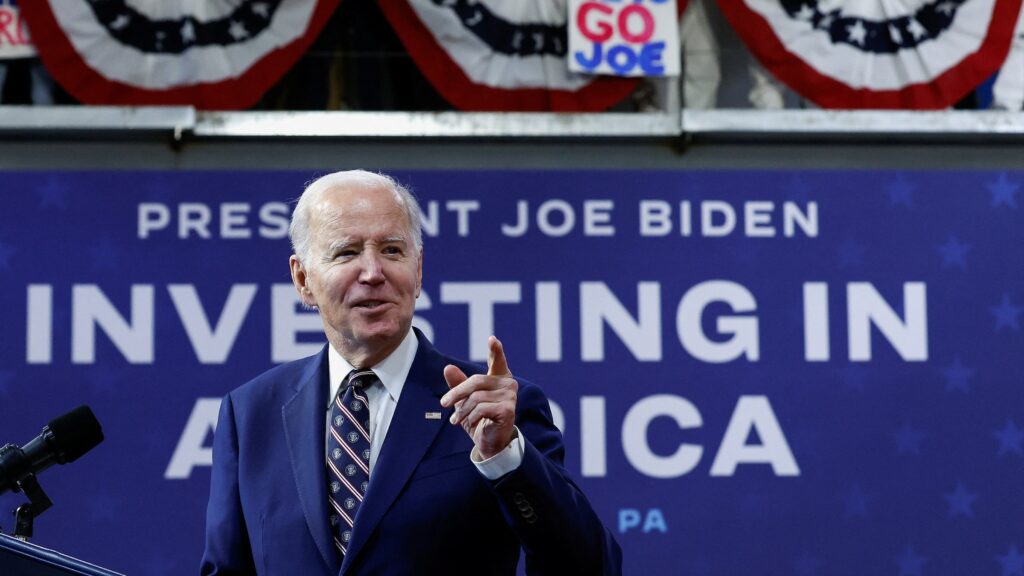

President Joe Biden released a tax-and-spend budget proposal for fiscal 2024. (Photo: Detroit Catholic)

On Thursday, President Joe Biden released a tax-and-spend budget proposal for fiscal 2024 that includes approximately $6.9 trillion in spending and would result in a $1.8 trillion deficit, adding to the country’s high debt.

Biden’s budget proposal, which is not legislation but rather a suggestion to Congress outlining his priorities, paints a picture of an ambitious tax-and-spend budget agenda, which the Republican majority in the House strongly opposes. Based on a slew of spending proposals offset partly by tax increases, the plan would result in a $17 trillion deficit over the next decade.

Despite the rising debt, the White House emphasizes how the proposed plan would cut the deficit by $3 trillion over the next ten years if implemented as proposed.

The tax-and-spend budget increases Medicare spending, fueled by tax increases, and calls for strengthening Social Security. It includes a plan to avoid the insolvency of the Medicare hospital insurance trust fund, which the program’s trustees predict will run out in 2028.

In addition to broadening drug pricing reforms, the Biden proposal would raise payroll taxes on those earning more than $400,000 to fund Medicare benefits. It would specifically raise the Medicare tax rate for taxpayers earning more than $400,000 annually from 3.8% to 5%.

READ ALSO: $227 Billion Budget Proposal in New York Will Be Spent on Economic Recovery, Gov. Hochul Says!

The tax-and-spend budget also proposes restoring the expanded child tax credit. Biden’s pandemic relief legislation for 2021 temporarily increased the child tax credit from $2,000 to $3,000 per child, with a cap of $3,600 for children under six, and made it fully refundable. The temporary extension will end in 2022.

The budget also includes $59 billion in mandatory funding and tax breaks to increase affordable housing supply, including for extremely low-income households.

Furthermore, the budget would increase the Social Security Administration funding by 10% over this year’s spending. The plan includes investments in personnel, information technology, and other improvements.

To pay for the tax-and-spend budget, Biden’s budget proposes a series of tax increases on the wealthy while promising not to raise taxes on those earning less than $400,000 per year.

Interest rates have risen rapidly in recent months due to the Federal Reserve’s campaign to reduce inflation by raising interest rates. Higher interest rates threaten to dramatically increase the cost of servicing the federal debt, hastening the country’s debt reckoning.

Several years of ultralow interest rates, particularly during the pandemic, allowed the federal government to incur massive amounts of debt with minimal consequences. Still, higher rates are now exacerbating the government’s fiscal woes.