The Film Production Tax Credit program is intended to strengthen New York State’s film production industry and its positive impact on the state’s economy.

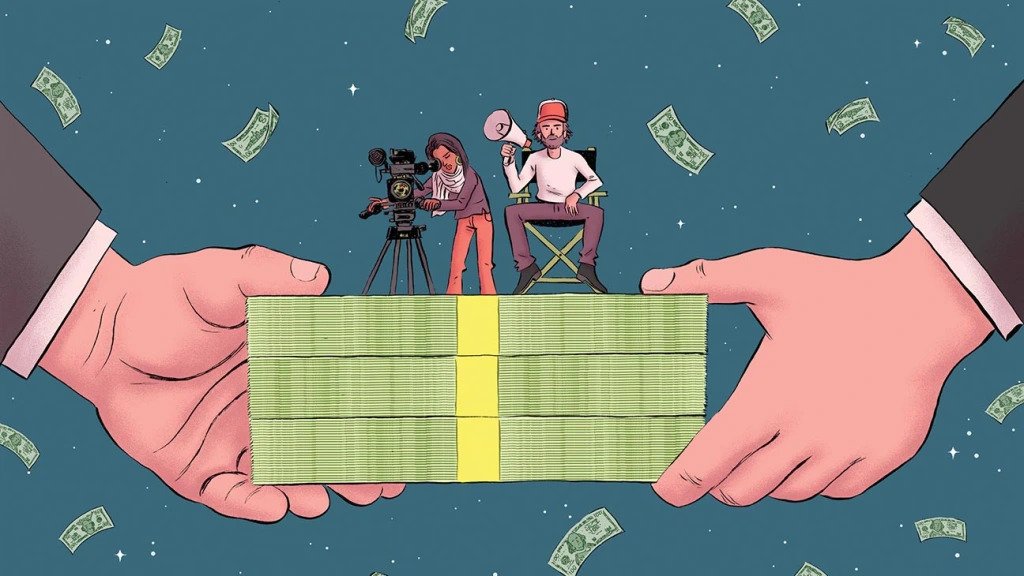

(The Center Square) — According to a new report, New York’s film tax credit is a giveaway to big Hollywood movie studios that gives the state’s taxpayers little in return for their investment.

According to the Empire Center’s report, New Yorkers are being taken advantage of by the generous film production program, which has distributed hundreds of millions of dollars in refundable tax credits. According to an Empire State Development spokeswoman, the argument is flawed.

The fundamental rule behind any economic development tax credit is that it is supposed to result in more tax receipts than the state is foregoing,” Empire Center fellow Ken Giradin wrote in the report, “but the state has never demonstrated that New York state taxpayers are coming out ahead in three rounds of economic studies.”

According to the Empire Center’s report, New York’s most recent economic impact study on the tax credits attributed an estimated $1 billion in state tax receipts to economic activity from $2.1 billion in film tax credits issued in 2019 and 2020.

“In other words, according to the state’s own estimates, New York state taxpayers lost approximately 49 cents for every dollar in film credits,” Giradin wrote.

The report comes as Governor Kathy Hochul pushes for up to 35% reimbursement for film and television productions, as well as an increase in the amount of credits to $700 million per year.

Hochul, a Democrat, has also proposed making film writer and director salaries eligible for tax credit reimbursement.

Giradin, on the other hand, claims that the state is losing money on the deal and that Albany leaders should instead be “yelling cut” to end the generous tax subsidy.

The state had expanded the credit to cover up to 35% of filming costs. (Photo: JAMIE COE)

According to the report, the state government has given Hollywood studios millions of dollars in capital grants, funded public agencies to facilitate filming, and picked up millions in job training costs from the studios.

“As a result, taxpayers in New York lose money on the state’s film tax credit,” he wrote. “They lose even more money on their overall support for the film and television industry.”

The film industry, according to Giradin, has “done an Oscar-worthy job of keeping lawmakers glued to a few key misconceptions about the tax credit.”

“Proponents have found sympathetic ears among Albany legislators, who are open to talking about “jobs” and enjoy being able to rub shoulders with celebrities,” he wrote.

“The state’s labor unions have defended the credit because it supports unionized crew and studio positions, and standing up for it has also paid dividends for politicians’ campaign coffers,” he added.

Since 2004, New York has had a film tax credit program, with credits totaling approximately $25 million per year, allowing producers to claim 10% of production costs.

The credit was eventually expanded by the state, making it worth up to 35% of filming costs by 2008. The state also made post-production work, such as visual effects and editing, tax deductible.

Republican lawmakers have introduced legislation to repeal the state’s film tax credit program each session, but the proposals have received little traction in the Democratic-controlled General Assembly.

Giradin stated that other states, such as Connecticut, are debating whether to eliminate film tax credits as part of broader discussions about eliminating ineffective corporate tax breaks.

He claimed that by eliminating the generous subsidies, New York could pave the way for other states, arguing that “films would be shot in New York regardless because that’s where so much studio and talent infrastructure is located.”

“He is saying these films would have filmed” in New York state without “the credit anyway,” Kristen Devoe of Empire State Development wrote in an email to The Center Square.

“The state loses money on the deal, so New York should immediately repeal its production and post-production tax credits,” Giradin wrote. “Because the credits are claimed years in advance, other states will have time to reduce their own – because they will no longer be competing with New York.”

Read also: Filing Tax Return to Get a Big Refund: Legit Or A Scam?