Income from third-party sales will soon require reporting as changes from the tax code have been proposed.

Income from third-party sales will soon require reporting as changes from the tax code have been proposed. (Photo: Bloomberg)

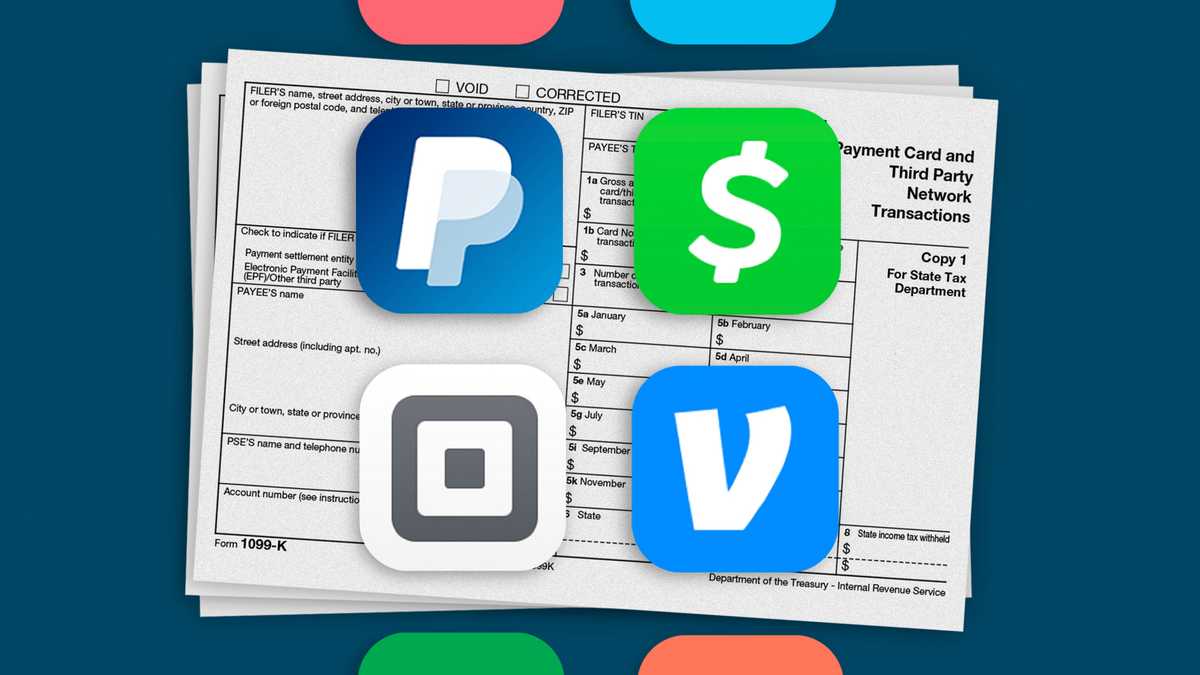

Third-Party Sales Income over $600 to Start Being Reported to IRS

All income over $600 from third-party sales will soon start being reported to IRS. Sales from Venmo, E-bay and other third parties are subject to these changes.

According to a published post by AS USA, changes in the tax code implemented by the American Rescue Plan (ARP) of 2021 could have serious effects on micro-and-small businesses all across the country.

Income from third-party sales will soon require reporting as changes from the tax code have been proposed. (Photo: Larson Accounting)

Small Business Are Required To Report Their Earnings When They Receive Through Venmo or Paypal

Companies and other small businesses that receive through Venmo or Paypal and get more than 200 sales valued at over $20,000 or more are required to report these earnings to the IRS. A measure to reduce the income level to $600 has been included by the ARP. This expanded the rule to cover the income from other third-party platforms that allow other users to sell goods and services like eBay, Rover, Poshmark, Esty, and many more.

The changes in the rules have yet to go into effect. This is because of last year’s reversed course of the IRS and with a totality no greater than the amount of $20,000. They have also opted to maintain the current limit of 200 exchanges. A large number of people work to service and sell goods as a way to provide additional income to cover basic needs is still not known. However, because of President Biden’s promise not to increase taxes for those that make less than $400,000 a year, this move could be seen as a violation.

READ ALSO: No More Backlogs: IRS Primed For A Better 2023 Tax Season