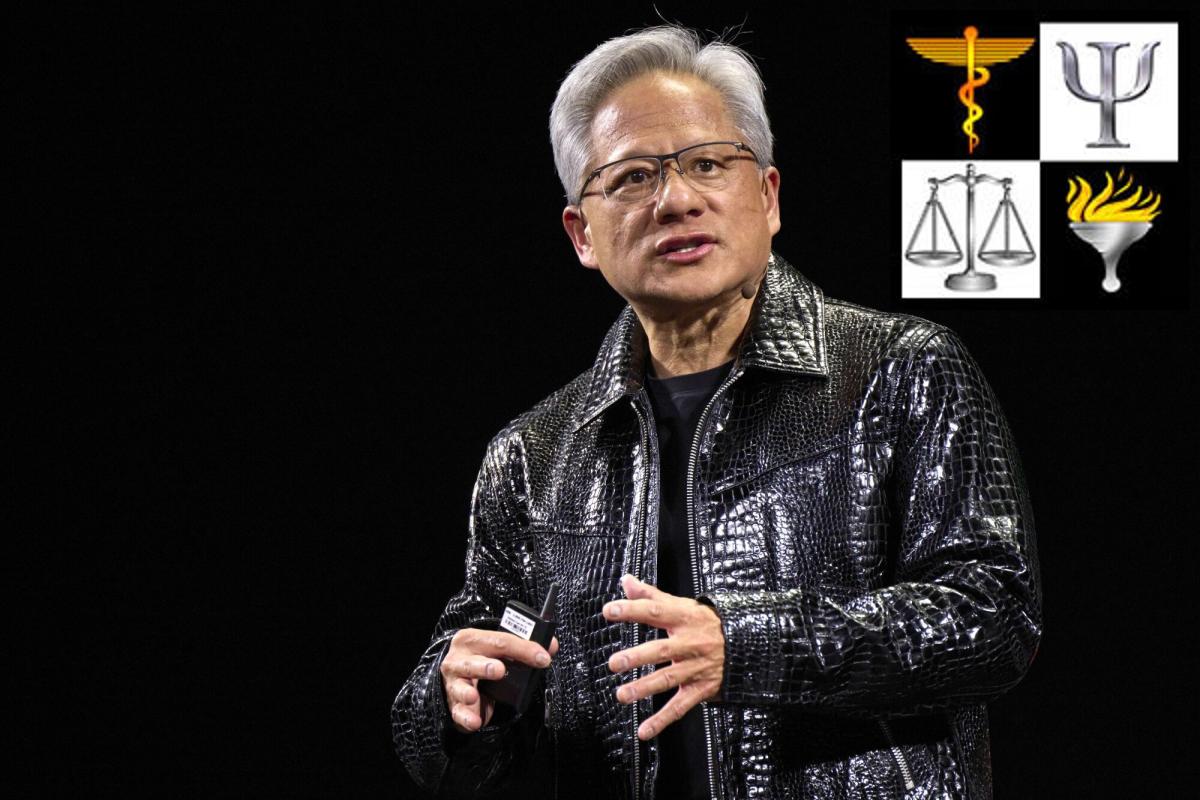

In a surprising turn of events, the shares of IonQ, a prominent player in the quantum computing industry, experienced a significant drop recently. The decline comes after Nvidia CEO Jensen Huang shared his concerns about the practical applications of quantum computers, suggesting that it could take decades before they become widely useful. This has sent shockwaves through the market, affecting not only IonQ but also other companies in the quantum computing sector.

What Happened?

On Wednesday, IonQ’s stock dropped by about 29%, while other key players like Quantum Computing Inc., D-Wave Quantum Inc., and Rigetti Computing Inc. saw their shares plummet by more than 30%. Huang’s comments about the long timeline for quantum computing to become practical have intensified worries among investors who had previously been optimistic about the technology’s potential.

The Rise and Fall of Quantum Stocks

Earlier this year, stocks in quantum computing had been on a dramatic rise, driven by advancements in technology and increased interest in the field. For instance, IonQ’s stock had surged by over 300% in the past months, reaching a peak price of approximately $49.59 before this sudden downturn. The excitement surrounding these advancements, however, has now been overshadowed by Huang’s cautionary outlook.

Investor Reactions

- Nvidia’s CEO stated that practical quantum computers may still be 20 years away.

- This prediction has caused investors to reconsider their positions in IonQ and similar companies.

- Despite the year-to-date performance still showing a 15.06% increase for IonQ, the immediate reactions to Huang’s remarks were anything but positive.

- The market capitalization of IonQ remains high at about $11.05 billion, but investor sentiment has certainly shifted.

What Experts Are Saying

Financial analysts have pointed out that while Huang’s comments reflect a cautious approach toward quantum computing’s future, it is crucial to monitor technological advancements within the industry. Many believe that periods of volatility are common in emerging technology sectors, and this could be just a temporary setback for IonQ and its peers.

The Impact Beyond IonQ

The influence of Huang’s statements wasn’t confined to IonQ alone. Several Chinese quantum technology companies, including QuantumCTek and Accelink Technologies, also experienced considerable share drops. The widespread reaction showcases how interconnected the quantum computing market has become, where news from one influential figure can ripple through many companies.

Looking Ahead

As the dust settles from this recent upheaval, it remains to be seen how IonQ and its competitors will respond. Investors are faced with the challenge of navigating through uncertainty but caution is advised, particularly in an industry that thrives on innovation and rapid changes. Observers suggest that keeping an eye on ongoing research and development is essential to understanding the potential future of quantum computing.

| Date | Event | IonQ Stock Price | Change |

|---|---|---|---|

| January 6, 2025 | Stock Increase | $49.29 | +3.2% |

| January 7, 2025 | Stock Plummet | (Not specified) | -10%+ |

| January 8, 2025 | Stock Decline | $49.59 | -2.84% |