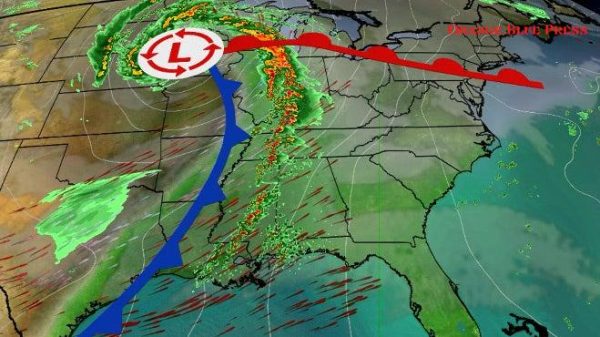

The U.S. Small Business Administration (SBA) has just made an important announcement that could help many businesses and individuals in Florida recover from recent disasters. The SBA has extended the deadline for applying for disaster loans, and this is some big news for those who might need financial help.

New Application Deadline

The new deadline for disaster loan applications is now set for April 27, 2025. This extension came after Florida requested more time for businesses and nonprofits affected by the hurricane season of 2024. If you know someone who has faced damage to their property or economic troubles because of the hurricanes, this is crucial information.

Who Can Apply?

These disaster loans are not just for big businesses; they’re also available for small businesses and nonprofits that have suffered losses due to the hurricanes. Additionally, individuals such as homeowners and renters can apply for loans that help repair damaged property. This program aims to support various types of applicants, making it inclusive for many who are in need.

Types of Loans Available

- Business loans to fix damaged property and assets.

- Loans for nonprofits to recover from economic injuries.

- Homeowners can apply for up to $500,000 to repair their homes.

- Renters can request help for home and property repairs.

How to Apply

Applying for these loans is quite straightforward. The SBA has set up business recovery centers where applicants can go to receive assistance. It’s important to gather all necessary documentation and understand the requirements before applying, as this will make the process smoother and more efficient.

Why This Matters

With the challenges brought on by the hurricanes of 2024, many people are looking for ways to recover. The SBA loans are designed to fill in gaps where other aid sources, like insurance, may not fully cover the damages. For many families and businesses, this financial support could mean the difference between bouncing back and struggling to survive.

Support and Resources

If you’re interested in these loans or know someone who might be, it’s essential to spread the word. Encourage potential applicants to check the SBA’s official website for more detailed information or visit local recovery centers. They can get help not only with the application process but also with understanding the types of aid available to them.

Conclusion

In conclusion, the extended deadline for SBA disaster loans offers a renewed opportunity for those affected by last year’s hurricanes to seek the financial aid they desperately need. This support reflects the commitment to helping communities recover and rebuild, demonstrating that even in tough times, there’s hope and assistance available.