Tesla’s stock has been on quite the rollercoaster lately, with prices shooting up significantly over the last few months. Investors are paying close attention to this buzz because it reveals exciting new directions for the company beyond just electric cars. In this news piece, we’ll explore the reasons behind this stock surge and what it could mean moving forward for Tesla and its investors.

What’s Driving the Stock Surge?

One of the biggest factors influencing Tesla’s stock rise is the excitement surrounding its plans to expand into autonomous vehicles and robotics. This means they are not just focusing on making electric cars but also want to create self-driving cars and even robots that can help people in their daily lives. Many investors believe this shift could multiply their profits significantly in the future, which is why they are showing a keen interest.

Elon Musk’s Influence

A lot of the talk around Tesla’s stock is linked to its boss, Elon Musk. Musk’s efforts to align with influential political figures, like those in the Trump administration, have possibly made it easier for Tesla to navigate regulatory challenges. This benefits investors since smoother regulations could lead to faster company growth. Interestingly, since the election last November, Tesla’s stock price has spiked by nearly 70%!

What’s Next for Tesla?

Looking ahead, there are some thrilling developments anticipated from Tesla. Musk has projected that autonomous ride-sharing services could hit the streets in places like Texas and California by 2024. They’re also preparing for the launch of their “Cybercab”—a robotaxi designed to be affordable to many, with production expected to ramp up by 2026. Also exciting is the Optimus robot, for which sales are also expected to begin in 2026.

The Vehicle Business and Its Challenges

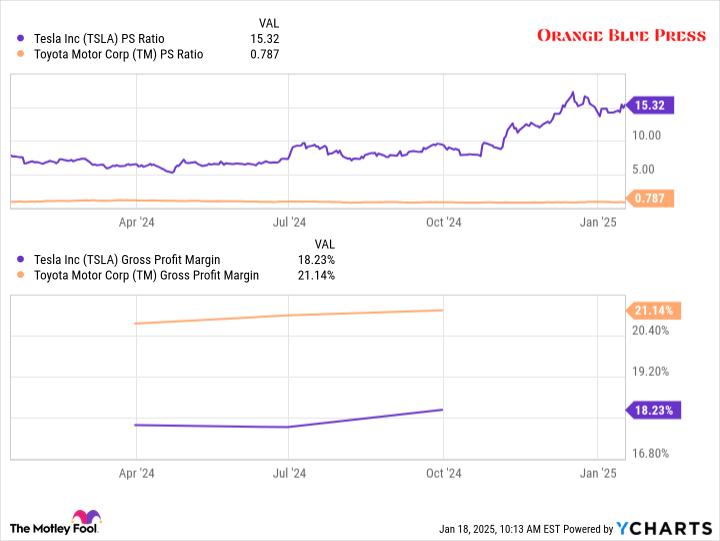

Even while Tesla’s stock is soaring, there’s a reality check: the car production numbers are slipping. For the first time, Tesla’s vehicle production saw a decline in 2024. Given that their vehicle business currently generates almost all their revenue and profits, this brings about questions about the sustainability of their astonishing stock valuation. Right now, Tesla is valued at over 15 times its sales, while competitors like Toyota are valued at less than one.

Tesla vs. Rivian: A Comparative Look

In terms of competition, Rivian, another electric vehicle manufacturer, faced a tough year with their stock dropping about 43% while Tesla’s surged. In 2024, Rivian delivered just under 52,000 vehicles compared to Tesla’s nearly 1.79 million. Rivian encountered production problems due to plant shutdowns and parts shortages, which affected their performance in comparison to Tesla’s recent success.

What Analysts Are Saying

Financial experts are busy projecting what this means for the future. While Tesla’s current increase makes it a powerhouse in the market, many analysts suggest that the stock might have limited upward movement after such a large jump at the end of 2024. On the other hand, Rivian is hoping to turn their fortunes around with cost-cutting methods and a new affordable SUV expected to launch in 2026.

| Company | 2024 Vehicle Deliveries | Stock Performance (Yearly Change) |

|---|---|---|

| Tesla | 1,790,000 | +70% |

| Rivian | 51,579 | -43% |

While Tesla’s exploration of autonomous technology and robotics is exciting, it’s crucial for investors to keep an eye on the company’s core vehicle business. With a lot of eyes on them, the unfolding story of Tesla stock is sure to be filled with ups, downs, and many twists!