In a bold move, President-elect Donald Trump recently announced plans to create a brand-new agency called the ‘External Revenue Service’. This agency is designed to collect tariffs and other revenues from foreign countries, a proposal that could reshape the way the United States manages its international trade and finances.

A New Approach to Tariffs

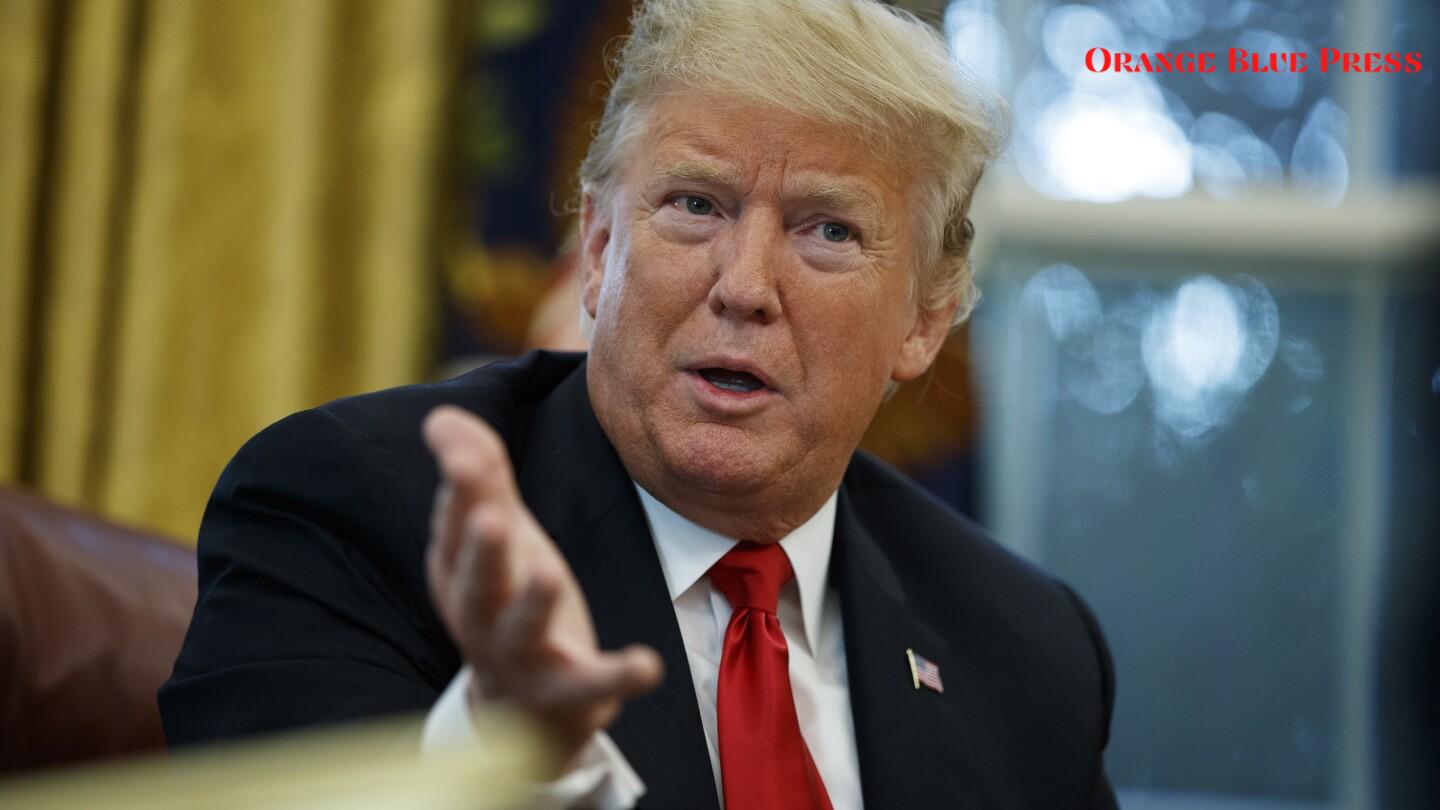

Trump made his announcement on January 7, 2025, while addressing supporters at his Mar-a-Lago estate. He expressed frustration with existing trade agreements, which he described as weak and unfair. According to Trump, the creation of the External Revenue Service is meant to ensure that foreign nations contribute their fair share to the U.S. economy.

How Will It Work?

- The External Revenue Service will take over responsibilities currently handled by U.S. Customs and Border Protection.

- Tariff collections are expected to increase significantly. Trump suggested potential tariffs of up to 25% on imports from Canada and Mexico, and 60% on goods from China.

- This initiative not only aims to gather more revenue but also to protect American jobs by making foreign imports more expensive.

Why the Change?

The administration believes that existing agencies are not collecting enough revenue and that a new agency could streamline the process and maximize collections. Critics, however, argue that these tariffs could lead to higher prices for American consumers. Economists have warned that tariffs can result in inflation and increased costs for everyday products.

What’s Next?

The plan will require approval from Congress, where Republicans hold a majority in both the House of Representatives and the Senate. Trump’s proposal is part of a broader strategy dubbed the ‘Save America’ agenda, which focuses on reducing the size and scope of the federal government. With key supporters like Elon Musk and Vivek Ramaswamy leading the charge, this initiative promises to shake up the current economic landscape.

Critics Weigh In

Not everyone is on board with Trump’s plans. Democratic Senator Ron Wyden has come out strongly against the proposal, branding it a tax increase on American families and small businesses. He emphasizes that more tariffs would only burden everyday citizens rather than helping the economy.

The Public’s Response

Public reactions are mixed so far. Some Americans appreciate the focus on collecting revenue from foreign entities, feeling that it could lead to better financing for domestic projects. Others, however, fear that this could result in major price hikes at stores nationwide. The uncertainty surrounding how these tariffs will be implemented adds to the concern among consumers and businesses alike.

A Look at Tariff Revenue

To understand the potential impact of this new initiative, it helps to look at past tariff collections. In 2023, the U.S. government collected around $80 billion in tariffs. The External Revenue Service aims to increase that figure significantly, altering how the U.S. interacts with foreign markets.

| Country | Proposed Tariff (%) |

|---|---|

| Canada | 25% |

| Mexico | 25% |

| China | 60% |

As Trump moves forward with his plans for the External Revenue Service, many will be watching closely to see how this will affect everyday lives and the broader U.S. economy. Whether or not this new agency will deliver on its promise remains to be seen, but it certainly has sparked a lively debate throughout the nation.