To be required to file a tax return, you must have previously earned a certain amount of money, which is the minimum amount.

Tax returns are not required for everyone in the United States. Some people are exempt from the filing requirement, which may be a relief. However, it could also be a negative thing because you have not earned enough money. As a result, if you have no other financial support, it will be difficult to make ends meet.

Every year, from January to April, most employees must deal with the filing of their tax returns, whether they like it or not. It is critical that all taxpayers understand their tax responsibilities, including not only filing but also paying any taxes owed to the Internal Revenue Service -IRS. In this way, they can avoid penalties. However, if you want to forget about your tax return, a tax preparer could be a solution.

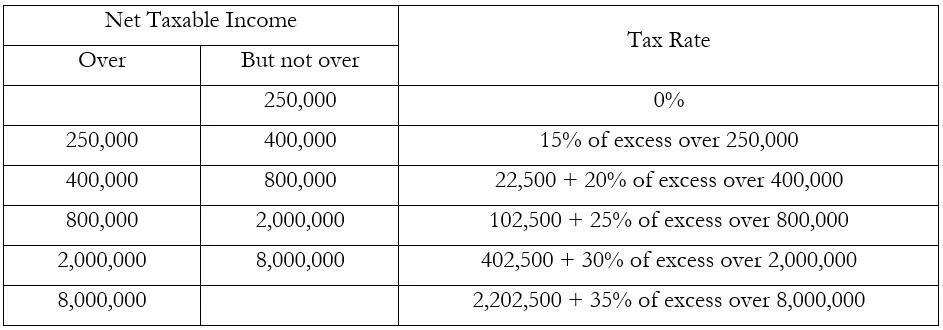

Regulatory tax update beginning Jan. 1, 2023(Photo: https://www.grantthornton.com.ph/)

How much money do you need to make to file a tax return with the IRS?

If you are self-employed, the IRS requires you to file a tax return and pay the required quarterly tax if your net earnings are $400 or more. However, for the vast majority of taxpayers, it will be determined by their gross income, age, and the required threshold. As a result, there is no single amount that applies to everyone. Thus, if you are a single filer under the age of 65, you must file a tax return if your gross income is at least $12,950.

If you are in the same situation but are over the age of 65, the amount is slightly higher, $14,700. Heads of households under the age of 65 who earn at least $19,400 must file a tax return. However, being older allows you to have a higher threshold, $21,150. As you can see, those over the age of 65 receive some additional assistance to compensate for their low retirement benefits.

What is the bare minimum for filing an IRS return if you are married and do it jointly?

Once again, married couples filing jointly will have a different minimum. Again, it will depend on age. If you are married and want to file jointly but are under the age of 65, you must file a tax return if your income is at least $25,900. Older married couples filing jointly can earn at least $27,300 (one spouse) or 28,700 dollars (both spouses).

Surprisingly, those who are married filing separately and earn at least $5 must file at any age. Last but not least, qualifying surviving spouses. If you earn at least $27,300 and are over the age of 65, you must file a tax return. Those under the age of 65 can earn at least $25,900 per year.