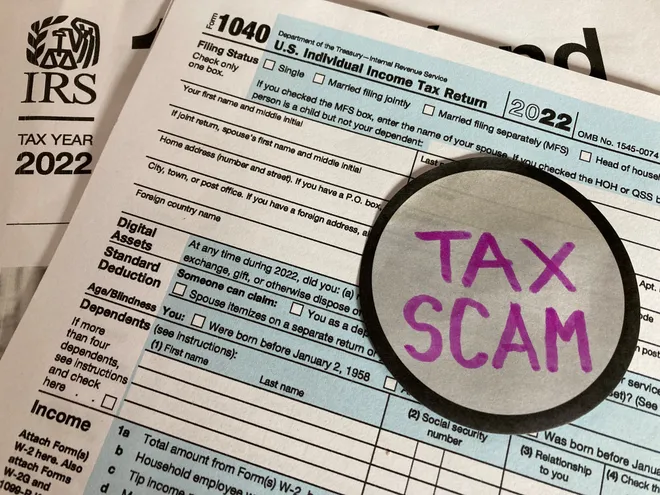

The Internal Revenue Service warns taxpayers of the new scams that urge people to use wage information on a tax return to claim false credits in hopes of getting a big refund.

IRS Warns Taxpayers About 2023 Filing Season Scams Of Form W-2 Wages And Fake Tax Refund (PHOTO: Detroit Free Press)

IRS Warns Taxpayers Of New Payment And Tax Refund Scams

The Internal Revenue Service or IRS keeps sending warnings to taxpayers due to the boost in scams during the tax season in 2023. One scheme, which is spreading in social media, encourages people to use tax software to manually fill out Form W-2, Wage, and Tax Statement, and include false income information. In this W-2 scheme, scam artists prefer people to make up large income and withholding figures as well as the employer it is coming from. Scammers then instruct people to file the fake tax return electronically in hopes of getting a substantial refund sometimes as much as five figures due to a large amount of withholding.

Unfortunately, even IRS warns taxpayers and citizens of this threat, but still many still take the bait. This is a very unpleasant crisis for those who fall for it, and that is why it is so essential to spreading this information. The first thing that every taxpayer learn is the way the Internal Revenue Service reaches taxpayers when it is necessary. More often than not, the IRS will just send you a notice or letter by mail and, this is not always the case for all taxpayers. Sometimes the IRS will contact you or even visit you in your house or business. It could be the case that the IRS sends you a revenue agent or officer, mainly because of audits or unpaid taxes.

The IRS Will Not Send Text Messages To Taxpayers For Bills Or Refunds

IRS warns taxpayers that they do not send text messages to taxpayers to deal with bills or tax refunds, it is more than likely that it is a scam if you obtain one. Do not open any links or provide any of your personal information to them. The IRS will never send you any links through text messages to verify anything. IRS may send you a text message regarding IRS Secure Access.

It is important to report it right away if you receive a text message from the IRS that you have not requested it. This is the e-mail phishing@irs.gov address you could do so to attach a screenshot. Apart from the proof you should also notify the IRS of the time, date, time zone, and phone number. The IRS celebrated the national Slam the Scam Day on March 9.

READ ALSO:

Biden’s Budget Plan Worth $6.9 Trillion Calls GOP A Misguided Plan For 2024