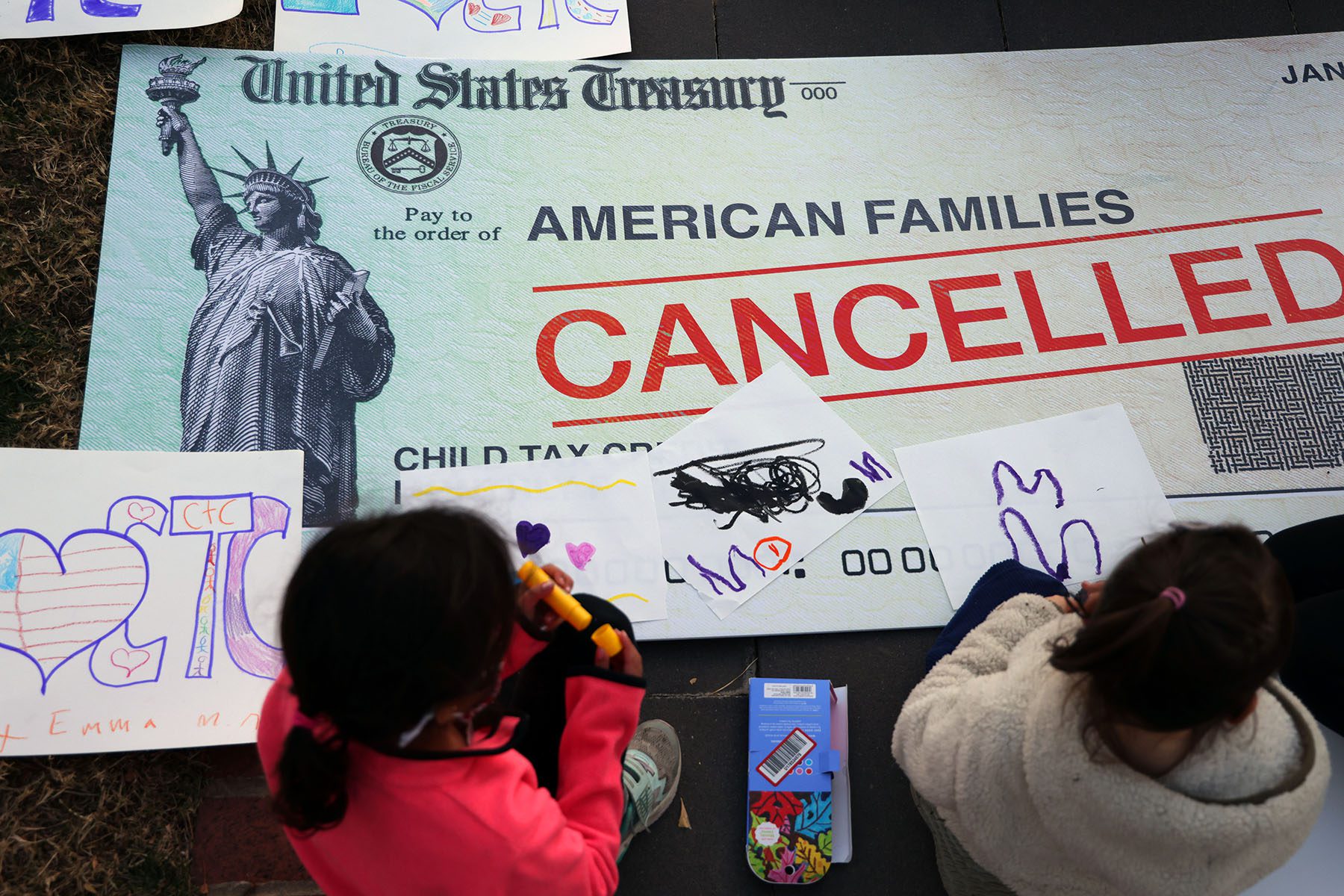

President Biden has called for the renewal of enhanced child tax credit payments for parents as part of his budget, which was released this week.

However, getting Congress to approve the terms may be difficult.

President Joe Biden’s proposed budget for fiscal 2024 includes a slew of family-friendly initiatives.

One key proposal is the reinstatement of the enhanced child tax credit, which temporarily provided qualifying parents with up to $3,600 per child through the American Rescue Plan for 2021.

Biden’s proposal would increase the current maximum child credit from $2,000 to $3,600 for children under the age of six, or $3,000 for children aged six and up.

The budget also proposes making the child tax credit fully refundable in perpetuity, which means that people would be eligible even if their tax liability was less than the credit amount.

The expanded child tax credit, which includes monthly payments of up to $300 per child, has helped to cut poverty in half, to the “lowest level in all of American history,” according to Biden in a budget speech on Thursday.

“We were very pleased to see that the White House is redoubling its efforts to support this direct cash payment program,” said Anna Aurilio, federal campaign director for the advocacy group Economic Security Project Action.

The expansion of the credit would be accompanied by other policy proposals in the president’s budget that would benefit both individuals and families.

The earned income tax credit for childless workers would be permanently expanded, with the goal of keeping low-wage workers out of poverty.

All employees are entitled to 12 weeks of paid family and medical leave, as well as seven paid sick days, under the plan. It also aims to increase access to low-cost childcare and free preschool. The budget also proposes expanding Medicaid home and community-based services, allowing older and disabled people to remain at home and relieving family caregivers and home care workers.

“It will help millions of parents go to work knowing their children are cared for,” Biden said of the budget on Thursday.

To be sure, the proposals, including the push to renew the expanded tax credit, may be difficult to pass in Congress.

US President Joe Biden speaks during the 2023 International Association of Fire Fighters Legislative Conference in Washington, DC, on March 6, 2023. (Photo by SAUL LOEB / AFP)

Biden wants to increase benefits while reducing the deficit.

Biden’s budget aims to reduce deficits by nearly $3 trillion over ten years.

According to a Tax Foundation analysis, extending the child tax credit for three years, adding a monthly payment option, and making it permanently fully refundable would cost more than $429 billion over a ten-year period. The expansion of the earned income tax credit for workers without qualifying children would cost approximately $156 billion.

Other research, however, suggests that government spending may have a positive impact.

According to Columbia University’s Center on Poverty and Social Policy, every dollar spent on the child tax credit results in a $10 benefit to society.

“People like it,” Aurilio said. “It’s extremely popular, particularly right now.”

This is because inflation has driven up prices for everyday items to levels not seen in decades.

While some argue that stimulus measures such as a larger child tax credit would fuel inflation, other experts disagree.

“The child tax credit was simply not large enough to have an impact on inflation, but it was large enough to assist families in meeting rising costs,” Aurilio explained.

More than 200 economists argued in an open letter to Congressional leaders in December that renewing the 2021 child tax credit would help low- and middle-income families cope with rising costs and promote economic health.

“Extending the expanded child tax credit is one of the simplest, most effective, and direct tools currently available to assist families in dealing with the impact of inflation on family budgets,” they wrote.

However, getting a new policy passed will be difficult, according to Aurilio. “K Street is working hard to resurrect corporate tax breaks.”

“We’ve always said that shouldn’t happen unless Congress also provides relief to families and workers by expanding the CTC and EITC,” she explained.

While some Democratic leaders have advocated for the policy, others, such as Utah Senator Mitt Romney, have led efforts for a more streamlined universal child benefit.

“The biggest challenge for Republicans or Democrats, I think, will be how you’re going to pay for it,” Romney said last year in an interview. “And my own opinion is that one, by reducing the size of the program.”

Romney also suggested repurposing funds from other programs, such as the child portion of the earned income tax credit.

Read also: Gov. Healey’s $742 Million Tax Relief Plan To Save Taxpayers Money