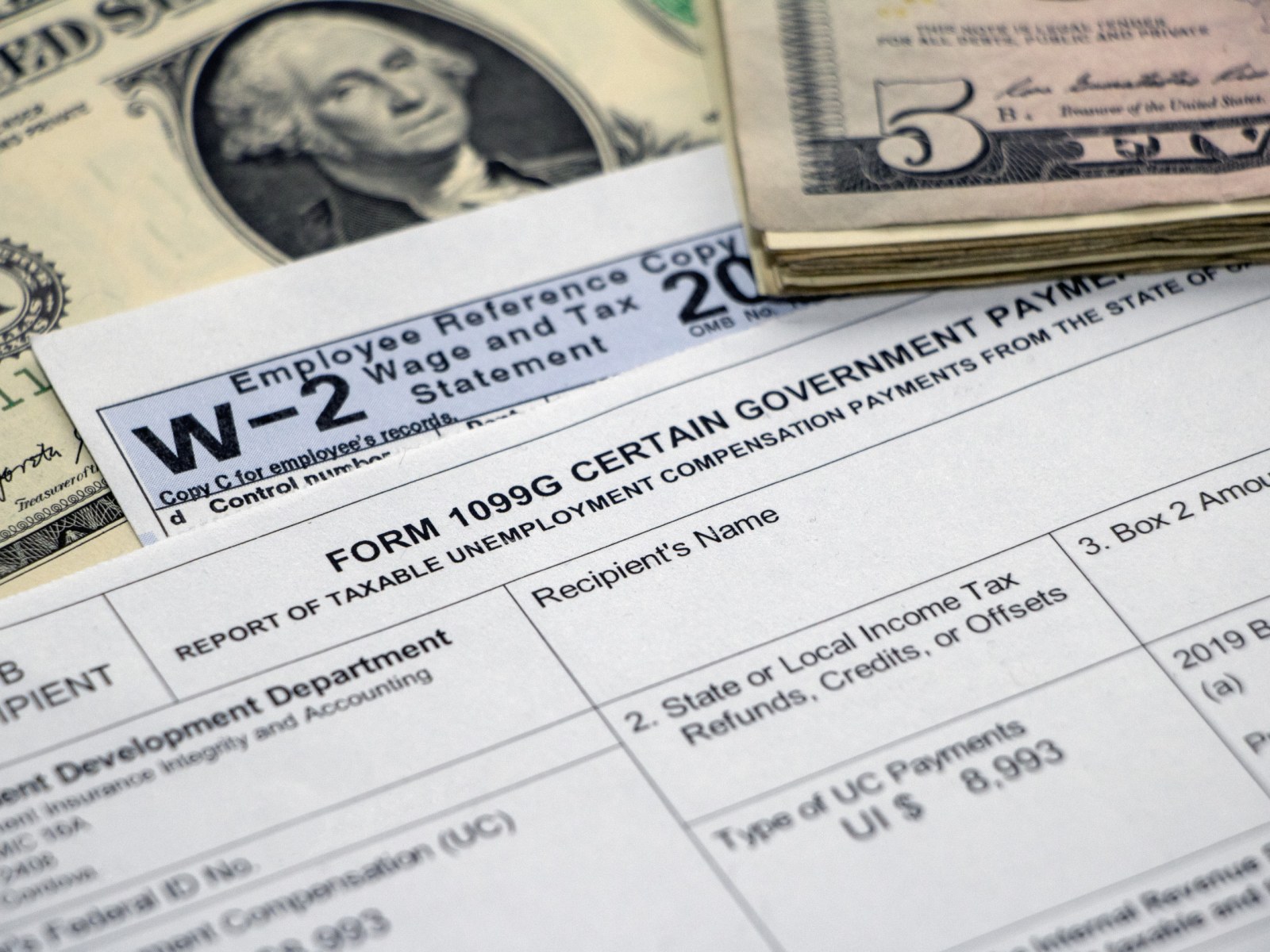

The federal and state taxes in 2023 work for unemployment benefits this tax season. Hence, If you received unemployment benefits in 2022, you’ll have to declare them when you file your taxes.

Taxes 2023: Unemployment Benefits Are Taxable In 2023 (PHOTO: NewsBreak)

The Taxes in 2023 Includes Unemployment Benefits

Generally, the federal government will tax your unemployment benefits, and the other states will as well. Unemployment benefits depend on your income and are taxed by the federal government at rates stated by the IRS’ tax brackets.

State taxes are a bit more complex and most states fully tax unemployment benefits just like they would for regular income. Some states don’t tax unemployment income at all, while others only partially tax the benefits. Visit here how your state taxes unemployment benefits here.

Here’s How Taxes Withheld From Unemployment Payments

State unemployment agencies authorize you to have federal and state taxes taken out of your unemployment checks. The IRS suggests you do this to avoid surprise tax bills. You can set this up when you first apply for unemployment, or at any point while you are obtaining it, by filing Form W-4V and sending it to your state’s unemployment agency. Moreover, will also have to fill out your state’s withholding form to have state taxes withheld from your benefit. Most states also permit you to do federal and state withholding online via their unemployment websites.

When you sign up for voluntary withholding, your benefits will be withheld at a federal flat rate of 10%, no matter your income bracket. If you determine not to sign up for voluntary withholding, you can also make quarterly assessed tax payments to avoid surprise tax bills.

READ ALSO:

Alaska Senators Propose A Pension Plan For State Workers

Michigan Inflation Relief Plan Has Been Finalized But The $180 Individual Relief Checks Is Excluded