The 2023 tax filing season officially began on January 23 and the deadline is on April 18. And taxpayers can file taxes for free!

IRS Free File 2023: Here’s How To File Your Taxes For Free! (PHOTO: The New York Times)

IRS Free File 2023

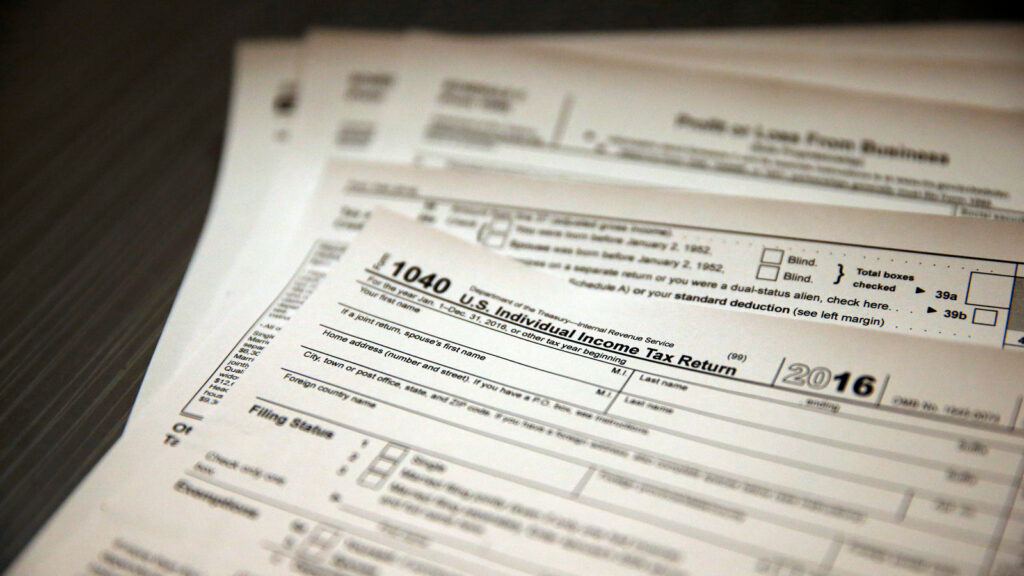

IRS Free File allows you to prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s secure and easy, and it’s free.

The IRS Free File Program is a public-private collaboration between the IRS and many tax preparation and filing software industry companies that provide their online tax preparation and filing for free. It supplies two ways for taxpayers to prepare and file their federal income tax online for free:

- Guided Tax Preparation provides online filing and tax preparation for free at the IRS partner site. The partners give service at no cost to eligible taxpayers. Qualifying taxpayers must have an AGI of $73,000 or less to avail of the free federal tax return.

- Free File Fillable Forms are electronic federal tax forms, equal to a paper 1040 form. You should know how to organize your tax return using form IRS instructions and publications if required. It provides a free choice to taxpayers whose income (AGI) is greater than $73,000.

These seven providers are connected to IRS Free File 2023 this tax season:

- ezTaxReturn.com

- FileYourTaxes.com

- TaxAct

- FreeTaxUSA

- TaxSlayer

- 1040Now

- On-Line Taxes

Taxpayers can utilize the IRS Free File online lookup tool to locate the right provider for them. The IRS says ezTaxReturn.com is offering Free files in Spanish for the 2023 tax season.

Other Options That Offer Free File

Beyond the IRS free file 2023, there are other options to file your taxes for free. The AARP Foundation has a program called Tax-Aide that provides free in-person and virtual tax assistance. Tax-Aide is available to all, regardless of income, although the program is concentrated on people over 50 who have low to moderate incomes. The program can help with most, but not all, tax returns. Cash App Taxes offers a free tax filing service with no income limitations for both federal and state taxes, but you have to download Cash App and log in to use the service.

Many of the biggest paid tax preparation services also offer free tax filing for simple tax returns, separate from the IRS Free File program. TurboTax’s free version includes W-2 income, limited interest or dividend income reported on a 1099 form, standard deduction claims, Earned Income Tax Credit (EITC), child tax credits, and student loan interest deductions. Moreover, H&R Block’s free version includes basic W-2 income, EITC, child tax credit, student loan interest deductions, and retirement income reports.

The Federal Trade Commission (FTC) announced last March that it was taking administrative action against TurboTax for misleading consumers about the availability of its free service. According to the FTC, TurboTax will inform consumers if they must upgrade to the paid version only after the consumer had entered sensitive personal and financial information.

READ ALSO:

54% Of Americans Are Using Savings Amid Inflation To Make Ends Meet

$1,500 Tax Rebate To Be Given As A Direct Payment From ANCHOR Program