Ohio’s savings account is now the largest in history with its recent fund transfer into rainy-day funds.

Ohio’s savings account is now the largest in history with its recent fund transfer worth $700 million into the rainy-day fund.

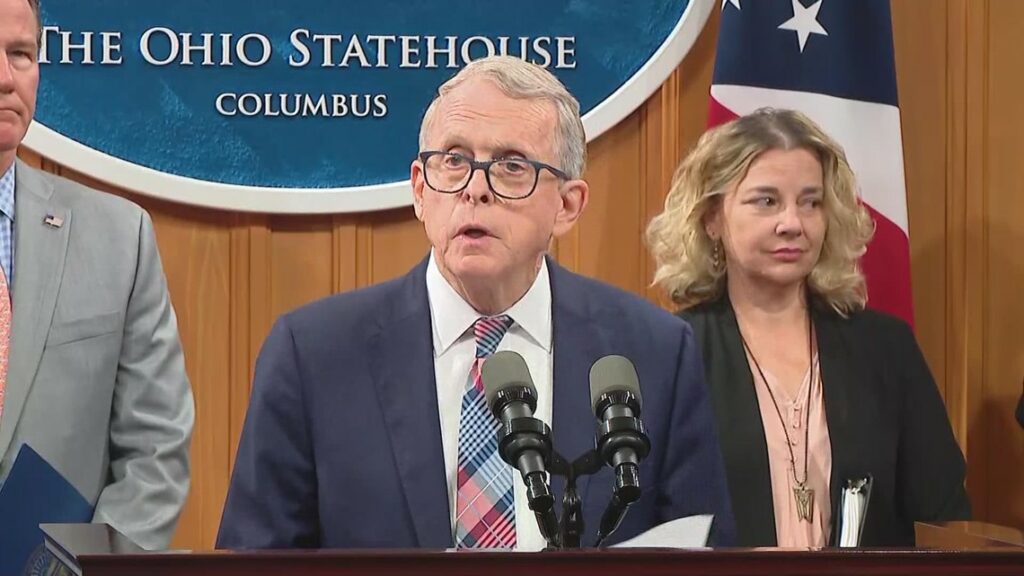

Ohio Governor Mike DeWine’s Statements

Governor Mike DeWine revealed the $727 million transferred into the Ohio Budget Stabilization Fund, otherwise known as the “rainy day” fund by the Office of Budget and Management, saying the record budget will guarantee that the administration’s policies are working.

In a Washington Examiner news, according to DeWine “We are providing on our promises to Ohioans with conservative management and sound budgeting.” DeWine also said that Businesses and investors can be assured that Ohio’s finances are in order. The Ohio governor is planning for the long term. Filling up the rainy day fund is another way of establishing strong results for the residents.

Greg Lawson, a research associate at The Buckeye Institute, believes the state savings account is positive but also thinks the high balance makes an opportunity for tax relief.

The Ohio Budget Stabilization Fund Or Rainy-Day Funds

The Ohio Budget Stabilization Fund or known as rainy-day funds is a reserve balance set aside during good economic times to have money available for state programs and departments during downturns. Ohio state law limits the fund to 8.5% of general fund revenues. The $3.5 billion currently in the rainy day fund is the max permitted by law. The Ohio General Assembly voted in House Bill 45 to transfer funds to reach that maximum rightful level.

The administration’s financial stability also led to recent positive rating actions from two prominent credit rating agencies. Fitch Ratings raised Ohio’s long-term Issuer Default Rating to “AAA” and Moody’s Investors Service elevated its outlook to “Positive” on Ohio’s “Aa1” Issuer rating.

To know more about the Budget Stabilization Fund, just visit obm.ohio.gov.

READ ALSO:

$100 Million Tax Relief Plan To Roll Out In Rhode Island; Gov. Dan McKee Says