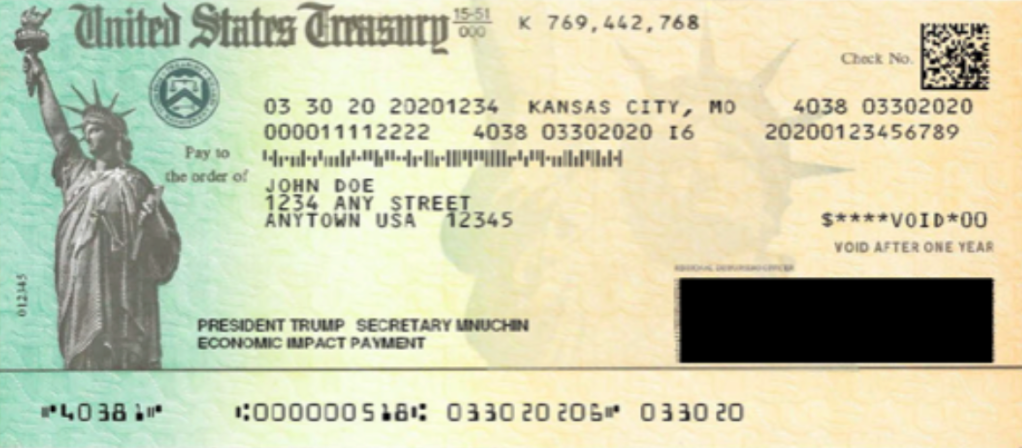

Colorado residents are to receive $1,500 checks. Taxpayers who filed their tax returns last October 17 can expect their rebates by January 31.

Taxpayers who filed their tax returns last October 17 can expect their rebates by January 31. (Photo: CNBC)

Millions of Colorado Residents to Receive $1,500 Cash Back Rebate

Last May, Governor Jared Polis signed a law to provide $400 payments for single filers and $800 for couples. They have been giving out checks this month and are planning to send out all rebates by next week. After the state received additional revenue, the payments are now $750 for single filers and $1,500 for couples.

According to the state’s revenue department, about three million Colorado taxpayers qualify for the cash-back rebates. Residents already received their rebates last September says The US Sun.

Colorado residents must be 18 years old on or by December 31, 2021, and have filed a state income tax return to receive the payments. Also, those who transferred to the state last year will not be eligible for the cash-back rebate. Taxpayers who did not file their returns could still be eligible if they applied for a property tax, rent, or heat credit rebate.

Taxpayers who filed their tax returns last October 17 can expect their rebates by January 31. (Photo: Marketplace)

Other States Also Giving Out Rebates

Since the trend of state surpluses surfaced, many other states started giving out rebates. Montana is one of the states planning to send out these refunds to its taxpayers. A $500 million property tax rebate is underway as state officials proposed this bill. Homeowners are to get $1,000 per year for the property in 2023 and 2024.

Massachusetts residents are receiving checks worth up to 14 percent of their 2021 income. This is because the state collected an extra $3 billion which went back to residents throughout the early part of December. Pennsylvania residents are receiving $1,658 rebates. People 65 and older, widows 50 and older, and people with disabilities aged 18 and older are eligible.

READ ALSO: $2,000 Property Tax Rebate For Montana Homeowners Under $2.4 Billion Surplus Tax