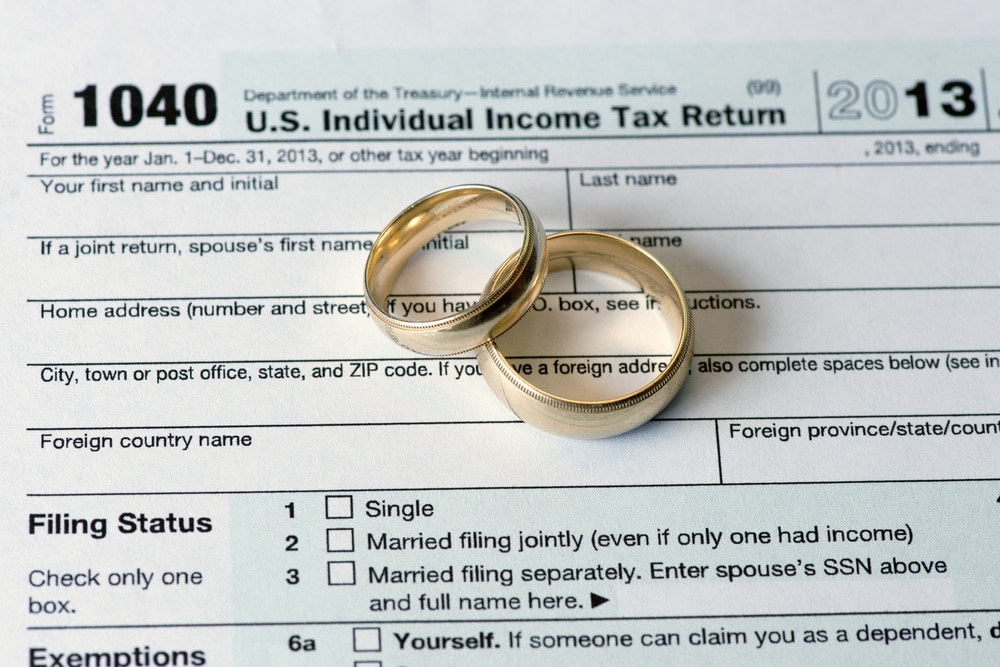

Being a US citizen’s spouse has a lot of implications. It is will be advantageous to know how the IRS views such relationships.

Being a US citizen’s spouse has a lot of implications. (Photo: Bright!Tax)

Is There a Need for Foreign Spouses to File Tax Returns?

The IRS has its guidelines on how to regard your foreign spouse which includes tax implications of having one. Being a nonresident, the spouse can still earn income and pay taxes in the US. The citizen partner can claim the spouse’s income on their tax return. According to a post by TaxUni, there are varied tax implications for claiming a foreign spouse’s tax returns.

As a citizen, you must learn about the laws affecting you and your spouse to qualify for special tax benefits and relief programs from the IRS. You and your foreign spouse will be treated as residents for the tax year after filing a joint tax return. This will make all of your income taxable. There are also tax breaks and deductions you can make use of like the Foreign Earned Income Exclusion and the Foreign Tax Credit.

READ ALSO: IRS Red Flags: How Not To Attract Their Attention?

Being a US citizen’s spouse has a lot of implications. (Photo: TaxUni)

Three Ways to Treat Your Nonresident Spouse as a Resident for Tax Purposes

Having a foreign spouse makes you eligible for varied tax deductions. There are three ways you can do to become eligible for this. The first and easiest thing to do is to file a joint tax return. There are conditions you and your nonresident spouse should meet. A social security number, an employer identification number, and a full address must be provided. Ways to obtain these numbers can be found on the IRS website.

The second option you can do is to file a separate tax return. To do this, your foreign spouse must have dependents and you must be a married couple. This filing is also called the “Head of Household” wherein the spouses must live together and spend at least half of the expenses. The nonresident spouse’s dependents must be included in your household and they must have a valid social security number.

The third option is treating your nonresident spouse as a retroactive resident. To do this you can file an amended return within three years of the original return date.

READ ALSO: IRS Form 1099-K: Myths About Payment Application Transactions