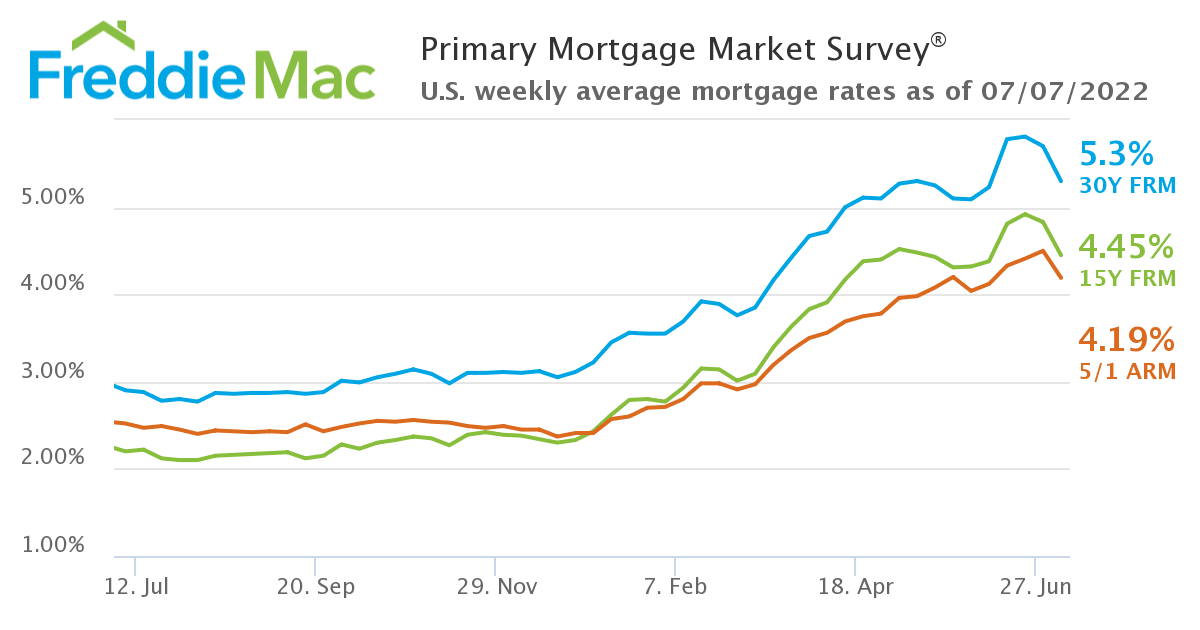

If you want to find the most interest saving when buying a home, you might want to consider a 15-year mortgage as rates go up across all repayment terms.

You might want to consider a 15-year mortgage as rates go up across all repayment terms. (Photo: The New York Times)

High Mortgage Rates for Home Purchases

Credible already compiled data showing high mortgage rates for home purchases across all terms. 30-year fixed mortgage rates rose to 6.625% from 6.500%, 20-year fixed mortgage rates rose to 6.500% from 6.125%, 15-year fixed mortgage rates rose to 6.375% from 6.250%, and 10-year fixed mortgage rates rose to 6.625% from 6.500%.

If you are looking for a higher interest rate, you can consider a mid-length term with rates for 15 years at 6.375% as stated from a post by Fox Business. This is a quarter point lower than rates for 10- and 30-year terms. Shorter terms mean higher monthly payments, but this gives you the most interest savings which allows you to pay the mortgage sooner.

You might want to consider a 15-year mortgage as rates go up across all repayment terms. (Photo: Investopedia)

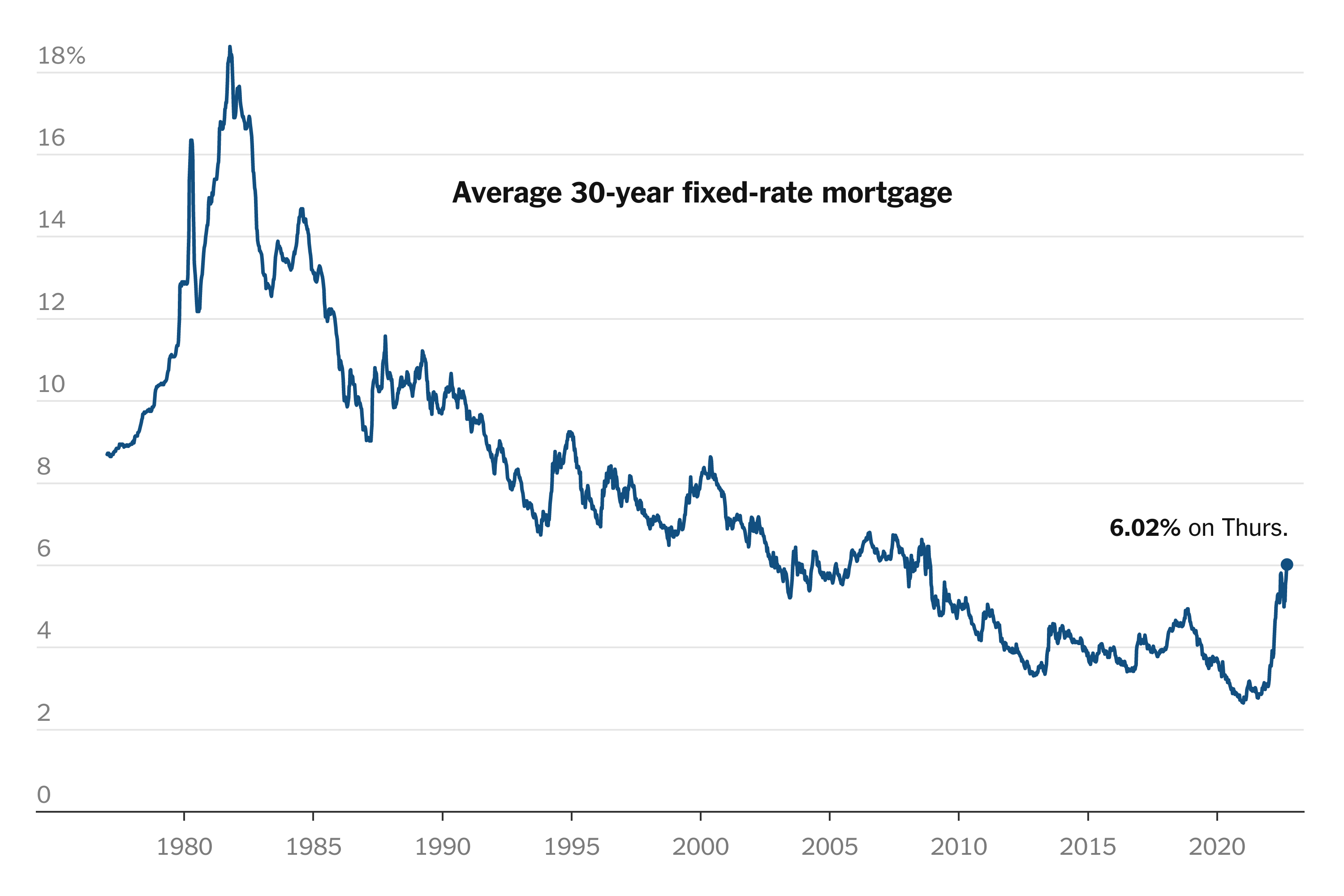

Mortgage Rates Changes Over Time

Current mortgage interest rates are still considerably low compared to the highest annual average rate recorded by Freddie Mac in 1981 which was 16.63%. Before Covid-19 struck, the average interest rate for a 30-year fixed-rate mortgage for 2019 was 3.94%. In 2021, the average rate was 2.96% which was the lowest annual average in 30 years.

This only means that homeowners with mortgages from 2019 and older could have more interest savings by refinancing with one of today’s lower interest rates. It is important to mind the closing costs when considering a mortgage refinance or purchase. Appraisal, application, origination, and attorney fees are the factors to consider together with the interest rate and loan amount when refinancing a mortgage.

READ ALSO: Wells Fargo Takes A Step Back From The House Market