The Federal Reserve, on Wednesday, December 15, raised the target interest rate before 2022 ends.

The Federal Reserve, on Wednesday, December 15, raised the target interest rate before 2022 ends.

Fed Raised Interest Rates

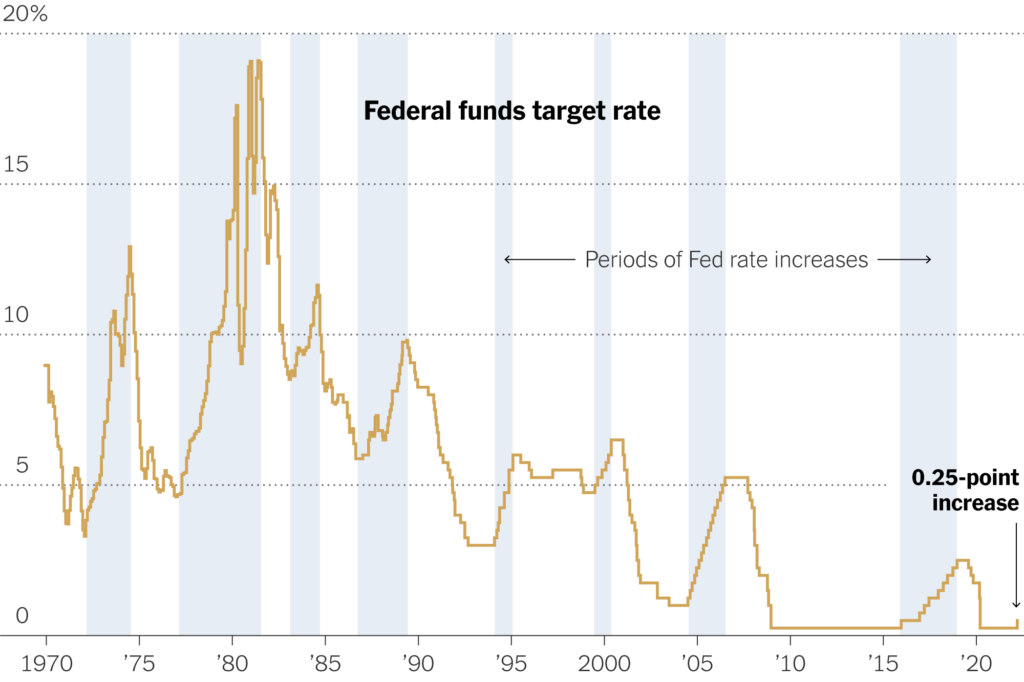

As 2022 draws closer the year Federal Reserve raised its target federal funds rate by 0.5 percentage points at the end of its two-day meeting Wednesday in a continued effort to cool inflation for the cost of living crisis that engulfed the United States. This was the seventh interest rate hike in the US this year, although this marks a more typical hike compared to the super-size 0.75 percentage point moves at each of the last four meetings, the central bank is far from finished, according to CNBC.

Furthermore, after Russia invaded Ukraine in march, the U.S. install sanctions on Russian accordingly. As a result consequence, it throws the U.S. at high prices of gas skyrocketed across the country with June witnessing the average price for a gallon of gas surpassing five dollars for the first time in United States history.

Hence, as America is in the midst of a cost-of-living crisis, the Federal Reserve has implemented a series of interest rate hikes that have ultimately stimied the rapidly increasing rate of inflation and lowered the price of necessities such as gas, groceries, and electricity, to the benefit of everyday Americans.

What Does This Hike Affect You?

A higher interest rate makes borrowing money goes up with the interest payment on loans higher than they are now. The recent interest rate hikes have already had devastating havoc on the housing market with most Americans now hesitant to own homeownership due to the higher interest payments.

Paying down any variable debt such as credit card debt should be an initiative for every American since the interest rates on credit cards are changeable they are somehow related to benchmarks set by the feds. With interest rate hikes set to continue in 2023, consumers are likely to avoid making any large purchases such as cars or houses.

The primary goal of the feds is to oversee the monetary policy of the United States and control the supply of money in the country’s economy. While the Fed has a variety of instruments at its disposal for the task, its ability to influence interest rates is its most prominent and effective monetary policy tool.